Chapter 13 - Data Communications: Adaptation 1979-1986

13.12 Network Equipment Technologies

In July 1982, MacLean, Chrisman and Caisse resigned from Tymnet to pursue the business opportunity their superiors had turned down. They knew no product existed to interconnect and switch the growing number of alternatives in wideband transmission services with customers’ lower speed data and even voice lines. They also did not believe the opportunity would go unnoticed for long. So they began meeting to plot their product and firm strategy. But after a month of intense conversations and debate, they found they could neither agree on a product specification nor who should play what management roles. In August, MacLean and Chrisman parted company with Caisse. MacLean recalls:

Art Caisse was contemplating building DTS microwave systems and Roger and I were dead set against that.”

In October, Chrisman’s wife, Sarah Schlinger, joined them. MacLean, more certain than ever of her views, remembers:

If you took those same networking concepts that we had employed in the X-25 packet switch arena, and brought them over to a physical layer only T1 network, and offered that same level of management control and reliability to the end user, that, combined with the economic and strategic motivations, would be a sure fire way to successfully win over a large number of the potential private network customers in the country.

They knew they needed others with complementary skills and knowledge, specifically a software expert with network management experience. There was equally no doubt who they wanted to join them: Robbie Forkish. Forkish had once worked with them at Tymnet and was now with Bell Northern Research, or BNR. So they called him up and invited him to lunch without signaling their true purpose. Surprised, Forkish told them he was happy were he was:

I went to BNR in ‘82. They were working on their next generation technology in their office automation area. I was interested in voice, number one, because even then, there were people who would look at our private network solution [Tymnet] and say: “But I’m spending 80% of my dollars on voice. What are you going to do for me there?” At the same time, I felt that, perhaps not so correctly, as it turns out, that the PBX was going to play a role competitive to the LANs.

Forkish also sensed the opportunity that was discussed and, after a group Thanksgiving dinner, he made the big commitment, although he would not formally begin until February of 1983.

After polishing their business plan, MacLean began calling on venture capitalists to raise the money needed to launch their company. She was making some progress but not with the first tier funds that she so desperately wanted. At the same time, the small team knew they needed to fill two noticeable holes in the founding team: a head of engineering and a president. Chrisman remember someone who had impressed him while working on the Caravan project at Tymnet: Walt Gill, the chief engineer of the Telecommunications Equipment Division, Avantek, Inc. Chrisman contacted Gill who independently had recognized the need for some kind of switching product. Gill was intrigued with the ideas Chrisman shared, but was unwilling to commit until he knew who was going to be president.

The venture capitalists asked MacLean the same question during her investment presentations. As difficult as that conversation can often be, a conversation frequently ending friendships or even a budding firm’s launch, MacLean recalls:

We all sat around a coffee table and said: “We’re not ever going to go to second tier venture firms.” We could have had the deal funded, quite frankly. I knew that I was going to be selling to Blue Chip companies, and I couldn’t do it without first tier venture funding and the right kind of management structure for the company. None of us had ever seen ourselves as the president of the company.

Fortunately the partners of one of the first tier funds was sufficiently interested that when the curriculum vitae of an executive looking for a start-up arrived unexpectedly in the mail, with a cover letter describing the opportunities he saw in telecommunications, opportunities sounding very similar to those in the business plan of MacLean and team, James Anderson, general partner with Merrill, Pickard, Anderson and Eyre, quickly put MacLean in touch with Bruce Smith. She recalls the synchronicity:

Bruce Smith, at the time, was the president of ComSat’s [Communication Satellite Corporation] Technology Products Group, and, as an officer of ComSat, had been one of the original partners on the board for SBS, so he had certainly had the same sort of thoughts in his head as he looked at what SBS had done wrong, how they had missed, and he saw what was happening from a regulatory standpoint, and was, in his own mind, thinking about the economic dislocations that would occur as a result of the break-up of the Bell System. He decided that he was not a big corporate guy and really wanted to go grow something on his own, and sent letters out to the venture community.

A first meeting, a lunch, was scheduled for April 1, 1983, Fools Day, even though MacLean would not be able to attend. Smith remembers the conversation with Chrisman, Forkish and Gill:

They described to me a product that they had come to in different ways: Walt out of installing a lot of datacom product in the microwave business and believing that there was an opportunity for products that interconnected in complex ways, topologies that weren’t point-to-point. At this point in time, nobody had a non-point-to-point product. So he came to it from an applications standpoint, where I came to it from a more broad environmental standpoint. Roger and Robbie had come to the idea that a box could be made which would largely be a data engine, and that perception was driven primarily out of the Tymnet perception that a network can be built around nodal engines. The rest of the world thought that, by the time you get smart, you had central office switches, or you had point products like PBXs that functioned independently – same thing with multiplexers that basically functioned independently of all the other ones that might be someplace else. So the Tymnet people had this concept of interconnectivity which is not at all different than the perception I had because of the time division multiple access way you manage satellite communications.

Smith and MacLean met soon afterwards in Washington, D.C. and had a similar meeting of the minds. Numerous phone calls followed until Smith and Gill mutually committed to joining the now credible enterprise in May. Three venture capital funds advanced $150, 000 so space could be leased and minimal offices assembled. Smith remembers:

We created a strategic statement of what it was the business was about, which was that the thousand largest companies worldwide, 600 in the US, were going, over time, as the world deregulated, to need a product which would allow them to interconnect this new, increasingly cheap, sets of bandwidth; that, at the beginning, bandwidth wouldn’t be cheap so the ability to interconnect it and use it efficiently was important, and using it efficiently meant voice and voice compression; that as bandwidth prices fell, efficiency of use would be less of an issue, but the ability to handle very complex topologies would become the issue – all of this in the concept of what this thing was as a manager of a fixed plant.

The concept of a manager of fixed plant emerged out of the deregulation of telecommunications, changing technological alternatives, and the growing importance of information to corporate management. Again Smith:

The overwhelming thing that underlies the conceptual framework for NET. was my perception that what had happened, or what would happen, would be a move from call/minute type economic thought to a fixed plant utilization type of thought, i.e. a fixed price, or cost, transportation plant that would be put in place for a variety of reasons and get increasingly close to the central production of business services in the company, but where the economic advantage, if you will, was in managing that fixed plant more effectively.

To know that they were not just talking to themselves, MacLean called on friends and former business associates and arranged for a trip back east in July to talk to decision makers of potential customers. Appreciatively Smith remembers:

Audrey, by some dint of magic, managed to set up a round robin trip for us, which included meeting with the telecom and information executives of some of the really major US companies, and we went out and we sat down with these people and just simply talked about their needs – talked about where they thought their businesses were going, and by the time we finished that trip, not only had we heard every single one of them say: “I don’t believe you can do it, but if you can do it I’ll buy a truckload.” We also began to comprehend the speed with which the applications environment was changing on these people. We got a real clear sense of fear – fear of the break-up, fear of costs rising, and fear of this enormous growth in demand without any ability to predict it.

They had a vision, they had the facts and they quickly finalized an operating plan. In August 1983, Oak Management Corporation; Merrill, Pickard, Anderson and Eyre; and J.H. Whitney & Company invested $4.4 million with a pre-money valuation of $2.1 million.11 Technically they incorporated as MetroLink, a name that MacLean insisted sounded like a sausage vendor. Smith, in typical let’s-get-this-decided-and-move-on, told the pregnant MacLean that she could not sit or excuse herself until the name question was settled. So a question that had nagged the group from the beginning took minutes to solve and Network Equipment Technologies was as if delivered. In September, Gill and Forkish started hiring engineers and the real work of clarifying and specifying the product began. Smith remembers:

In the early year or so it was all the engineering founders and then Walt, with me in the other direction having some conversations around and about, but there was a lot of architectural ‘What problem are we trying to solve?’ ‘How will that problem change over time?’ kinds of things at the front end of this, which probably came more from the fact that the people did not work together before, did not have common wisdom. Therefore, these things had to be settled. Out of that came a much stronger idea.

MacLean recalls the diversity of the talent they soon had sitting around the table:

NET was the only place where, really, you had X-25, data networking, voice telephony, speech processing and transmission backgrounds, all assembled from the early stage of the design effort.

What would make NET’s T-1 multiplexer unique was a space time architecture that emerged principally from the interpenetration of Smith’s understanding of satellite TDMA designs and Gill’s knowledge of large TELCO switch architectures. The result would be an approach that allowed NET to build larger multiplexers providing much higher availability and with the intelligence to handle more complex topologies than any competitive product.

The Network Equipment Technologies (NET) fixed plant manager, metaphorically thought of as the new railroad switch, switched circuits not packets. The design strongly reflected Smith’s knowledge of satellite TDMA architectures learned at Comsat and Gill’s familiarity with large TELCO switches, a design that would permit NET to build much large nodes and handle much more complex network topologies than the competition. Forkish remembers:

We never got stuck in the mode of debating the ‘connection versus connectionless’ issue because in a circuit switch it seemed pretty obvious that we would build connection oriented sessions. We wanted to be innovative, but we wanted to use proven technology in being innovative.

As the engineers teased every implication out of their concepts before building hardware or writing software, Smith fleshed out the plans for the organization, including the major, but seemingly obvious to him, decision to create direct sales and field service organizations. MacLean remembers with admiration:

Bruce built the kind of financial structure for the company that enabled him to build the sort of direct sales and service capability that I think was as critical to the success of NET as was the technology base. In order for us to really take a walk between the giants’ toes, the giants being IBM and AT&T, we would need to run faster, and furthermore we would need to have our own ability to deliver solutions to the end users who were all Blue Chip companies and expected us to have first tier funding, deep pockets, and the kind of documentation, training and service support that they knew needed to accompany a product that was going to sit strategically in the backbone of their network.

As confident as they were all becoming, there always existed the nagging concern that one of the leading Data Communication firms might introduce a product to better the one they were developing. Then in early 1984, they received an invitation to hear about the new T-1 multiplexer being introduced by Timeplex. They almost did not want to attend the presentation, fearing that their hopes to be first to market had been seriously dashed. Forkish remembers:

Timeplex had just announced their Link/1 product. There were people who thought that we should simply pack up our bags: Timeplex was going to walk away with this market and we shouldn’t even try. We attended a briefing in Santa Clara. They were describing what their product was going to do and be like. As we sat in the room, we noticed that people asked them questions about T-1. One of the questions was ‘How are they going to treat red and yellow alarms?’ Very standard in T-1s. Not only did they not know the answer, they didn’t understand the questions, and it was real clear to us that there was an opportunity whether Timeplex had a Link/1 or not, and it was that meeting, that Timeplex briefing, that we sort of became very encouraged again. We had a new resolve. We didn’t think of them as a threat, so we charged right off.

The will to constrain jumping in and creating a product until the product had been fully thought through soon paid big dividends. Forkish remembers with pride:

We actually coded the entire system in about six months. It was one of the most satisfying efforts I’ve been involved in. It was highly focused and well directed, but we had a charter and a goal, and we had developed precisely, or at least reasonably close, to where we thought we’d end up. In the first year, I was not at all a manager. I was very much a leader, if you can draw a distinction between those two. I was as much leading the ‘charge of the light brigade’ as anything, and that simply set up circumstances that can never be duplicated except in the environment of a start-up and creating something out of nothing.

MacLean may have been pregnant, but she was not going to let any overlooked possibility derail the success they were all beginning to feel:

I talked to a couple of presidents of large PBX companies at the time, and I saw that they were really perceptually frozen in this view of the PBX being the office controller, and I don’t think they could see the fact that there was an opportunity for someone to focus on the transmission management problem and offer value to all the PBXs in a way that left the user an autonomy of selection of PBXs. In fact, if you look at Intercom, they failed because they tried to do something similar to what we did, but included in it the PBX functionality, whereas we consciously stayed at the physical layer, did not usurp the addressing and routing functions of either the PBX or the front-end processor, because we knew that we could coexist with them if we strictly focused on adding intelligence to the transmission layer of the problem. So, I think that there’s the perceptual frozen-ness that keeps the mainframe from inventing the mini, from inventing the micro, and the same thing happened here, where the PBX guys thought they were going to control the world and the data guys thought that they were better than the PBX guys, and nobody was really thinking about the integrated problem, I think, in a way that was able to come in and not displace the installed bases that everybody had, but add value to it. Most of them were too intent on protecting their own product strategies, and that sort of myopic focus can really get you locked in to where you miss seeing an opportunity.

September 1984, the time had come to beta test their Integrated Digital Network Exchange (IDNX) on a customer’s premises. Two design choices that had both immediate and long-lasting competitive implications were voice compression and dynamic routing. Forkish first remembers their successful implementation of the yet to-be-standardized ADPCM and the advantages of working with a company wise to beta testing a product as any start-up. Forkish remembers:

We were very fortunate early on in having, as I guess would have to be the case, the customers by their nature were risk takers and they were also very supportive. They had some of their own prestige on the line of course. We had worked very hard and had a lot of pride in our voice processing capabilities and our voice compression was also a key differentiator. In fact, it was internally integrated to the system, but there were no standards for ADPCM at the time, so we decided instead of waiting, we were going to go with a proprietary approach. Well, there were concerns about what quality would be like, so the folks at Bankers Trust did what they called their Pepsi test. They sent a note through all their user organizations that said: “Starting in two weeks, on a Tuesday, we’re going to convert from PCM to ADPCM. Please let us know what you think,” and then they did it the next day. Sure enough, two weeks later they got complaints about ‘the quality is worse today than it was yesterday,’ and they said: “Oh, by the way, we did it two weeks ago. We’ll see what happened last night.” So they solved the problem of managing their own users in a very clever and creative way, and it’s interesting that the end user and the vendor had to be creative working together to make the installation a success.

To NET designers, dynamic routing meant much more than not forcing a customer to reconfigure hardware in the case of a circuit failure. They wanted the IDNX to re-route so quickly that the customer did not even know it had happened. Forkish remembers in 1988:

The thing that I felt very strongly about was not only that we should come out in the first release with rerouting capabilities, but the rerouting should be fast enough to largely make a failure in the network transparent. We gave demonstrations, the most impressive of which had two brokers talking on a phone and we were able to break a T1, have them be rerouted, and they didn’t know it had happened, and they were both from New York, which meant they were both talking at the same time, and we were able to demonstrate time and time again that the difference between fast rerouting and slow rerouting is not necessarily one simply that’s an incremental measure, but it’s the difference between a conversation being disconnected or continuing. It’s the difference between a host to host session having to be disconnected, go through restart procedures, or having a momentary pause in its transmission, and I think it’s that concept and what we ultimately dubbed ‘Applications Availability’ that became the key differentiator for NET.

Meanwhile, Smith and his financial officer, Thomas Rota, had begun the arduous process of raising more money. Exactly how much depended on their corporate strategy. Some investors balked on hearing how much would have to be raised to build a direct sales and a field service organization, money that would undoubtedly result in dilution and a feared lower return on their investment. Smith recalls the loggerhead:

The board of directors thought I was absolutely out of my mind, that the amount of money and dilution we’d have to tolerate was such that it was a whacko thing to do. My view was that “I’ll settle for a smaller piece of a larger pie, thank you very much, but I don’t know how to do this any other way,” and we got down to the point where I basically said: “If you want to run the business, you can do that. This is the only way I know how to make it successful, and I’m prepared to step aside if you don’t like that,” and that solved that. It was a necessary step on this particular issue.

In September 1984, NET raised a second round of venture capital totaling $7.5 million. The pre-money valuation was $15.0 million. NET had become a hot investment in no small measure due to Smith’s ardor:

I think an entrepreneur, to start one of these companies, at least to the point where he hasn’t been successful with one before, and where he doesn’t have a very fat bank account, has got to have a concept that he can believe in with almost a religious fervor. I believed that we had correctly identified the opportunity. I’m sure the investment community has a terrible time telling the difference between somebody who is religious and somebody who is a promoter, and then in those who are religious, which ones are right and which ones are not. I believe that that fervor was broadly shared in the company. We thought we understood the business better than anybody else on earth, and probably we did.

With money in the bank, a satisfied beta customer and a product ready for introduction, Smith staged another of his larger than life events, one meant to raise fear in their competitors and to inspire confidence in their potential customers:

We now had the operational problem which was ‘how do you convince a big company – a guy in a big company – to take a potentially career-limiting risk and put the lifeblood of his business in the hands of some wacky group of people from California that had not been in business for a year?’ Well the answer to that is you start developing a larger- than-life image. You convey the perception of credibility; you grab associated credibility wherever you can. We did our product announcement in New York at Morgan Stanley’s corporate auditorium, with a seminar with the likes of Howard Anderson of the Yankee Group and Dixon Doll and Alan Pearce and Dick Wiley.

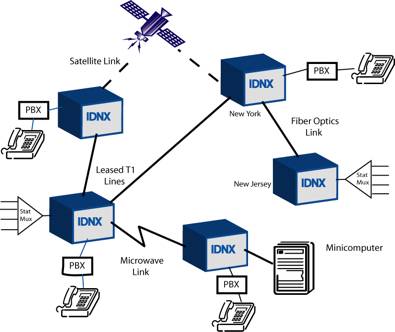

NET began shipping IDNXs in January 1985. The IDNX qualifies as the first truly networking T-1 multiplexer (The Timeplex Link/1 could create only minimally complex networks). A networking multiplexer differed from the point-to-point multiplexers in the complexity of networks that could be created and the embedded management control required. (See Exhibit 11.5 Example of an IDNX T-1 Multiplexer Network) Some of the key features that would distinguish the IDNX are:

- Demand assigned bandwidth allocation – calls could be set up on demand and bandwidth was used only for the duration of call.

- Dynamic alternate routing – no operator intervention was necessary

- Flexible network topologies

- Reliable system architecture

- Sophisticated voice compression – 32 Kbits ADPCM available

Exhibit 13.14.1 Example of an NET IDNX T-1 Multiplexer Network

In their first full fiscal year ending March 1986, NET’s sales totaled an astonishing $8.7 million. An impressive accomplishment given that Timeplex sold $11 million of its Link/1 in its first year and Timeplex had the advantage of an existing sales force and distribution network. Nevertheless, NET still loss $6.2 million, indicative of the considerable expense of building sales and support organizations.

- [11]:

“Stewart Greenfield of Oak Management would join the Board of Directors. He had also served on the boards of Micom and Ungermann-Bass.