Chapter 09 - Networking: Emergence 1979-1981

9.12 Micom: The DataPBX and IPO 1978-1981

Norred’s search for his replacement as Vice President of Development went quickly. Stephen W. Frankel knew as soon as he met Norred that he wanted to work for Micom. Frankel had spent the last seven years at another small data communication start-up, Tran Telecommunications, Inc. (Tran) – one of the earliest innovators of data PBX’s – where he had risen from software engineer to both Vice President of Engineering and Vice President of Marketing. When Tran agreed to be acquired by Amdahl, Frankel decided he had no interest remaining simply an employee, and began looking for an entrepreneurial opportunity. Seriously considering a new start-up, he then met Norred. They had an instant meeting of minds and he joined Micom in January 1980.

Frankel faced two immediate challenges: staffing an organization and finishing the development a number of products. Frankel remembers inheriting an organization consisting of: “Bill Norred and one very capable programmer and a couple of helpers and that was it.” Only Norred had little time for engineering, as he became absorbed in his expanded presidential responsibilities. Adding personnel became Frankel’s priority, for without staff, there was no chance of completing the unprecedented number of projects in process. Fortunately, four of the six projects were variations of the Data Concentrator, including adding modems for the first time.17 The Micro600 Port Selector, on the other hand, qualified as a truly challenging new development.18

As well as prior experience engineering dataPBXs, Frankel brought with him the personal energy and management discipline needed by Micom. He remembers the state of the Micro600 when he assumed responsibility for the project:19

The dataPBX didn’t work particularly well. It was in development and, not too much after I got there, it was going out in beta testing.

That the Micro600 had problems is small wonder given its architectural history. Norred had first proposed building a dataPBX for Case, one to replace the one they were OEM’ing from Gandalf in 1973.20 Case had declined.

Three years, later another customer, International Telephone and Telegraph (ITT), needed a telex switch to selectively monitor different ports and lines for problems. Norred developed a product that:

In effect, was the architecture of the dataPBX. But to be perfectly honest, I don’t even remember how we got from A to B in the dataPBX. I know that we developed it on the basis of taking our 5040 controller and developing the switching module which caused all the switching to take place. I remember, it was a product that was built for ITT with, almost by pointing, not by drawings.

In 1977, another customer, Computer Science Corporation (CSC), needed a product to connect lots of terminals with multiple computers. Norred recalls:

CSC was instrumental in the dataPBX as well, from a market standpoint, because they also were getting ready to buy a lot of these Infotron switches. Seems like we used to stay very close with CSC, in terms of what was going on. They were our customer that was very close in providing a lot of input to us and the direction we went.

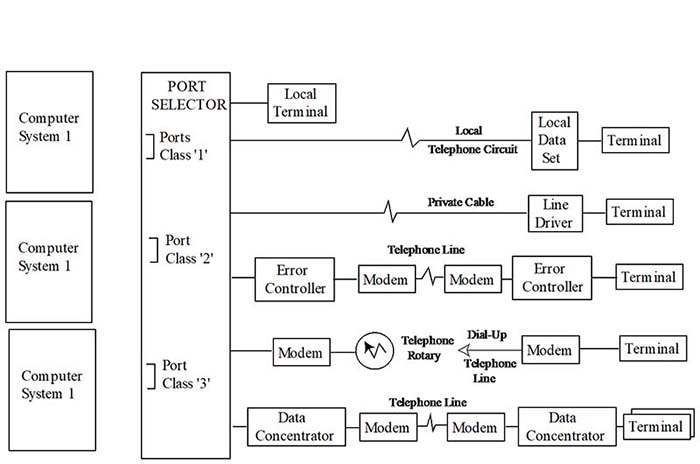

Micom began shipping their Micro 600 Port Selector in 1980. (Exhibit 7.2 Micom Micro600 Port Selector) Although not called a dataPBX, it was one: interconnecting many terminals and peripherals to multiple computers.

Exhibit 9.12.1 Micom Micro600 Port Selector

Fueled in part by the instant success of the Micro600, sales soared to $32.8 million for fiscal year ending March 1981, up 112% over 1980; straining Micom’s ability to finance growth from profits and its small capital base. With only $67,000 in cash and over $2 million in debt at March year-end, Norred and Evans welcomed investment bankers who told them the nearly decade-long dormant IPO market for technology companies showed stirrings of life, and that they should be prepared to take advantage of any window of opportunity. Their venture capital shareholders concurred, and given the incontestable fact that they needed capital if they were to satisfy the insatiable demand for their products, raising equity at the prices public investors were represented as willing to pay, well, it seemed like a no-brainer.

On May 21, 1981, Micom issued its Preliminary Prospectus and the investment bankers began coaching Norred and Evans for the road show: when management makes presentations to potential institutional investors in hopes of selling them on becoming buyers of stock on the offering. Before the road show began, Norred and Evans attended the important Interface trade show where Micom and all other leading data communication firms had booths. Catching them by surprise, Codex announced new multiplexers meant to replace the ones they were OEM’ing from Micom. Since Codex was a significant OEM customer, and OEM sales constituted 18% of Micom’s sales, the investment bankers expressed alarm, implying Micom’s business prospects looked far less attractive, and the IPO might have to be postponed, if not canceled. A financial disaster loomed. Norred and Evans tracked Carr down and asked if they could meet with him privately, over a cup of coffee. After nervous pleasantries, Carr remembers:

Roger said something like: “So you won’t buy any more of these?” And I said: “First off, nothing stops like a curtain coming down. We’ll have some number of these we’ll buy from you on probably a declining basis as ours comes up, but we’re interested in buying something else.” So he said: “You’re telling me you’re still going to keep buying from me?” And I said: “That’s what I’m telling you and that’s what you want to hear, Roger.’

With the IPO back on track, Norred and Evans began one of the simultaneously most exciting and most nerve-racking times for successful entrepreneurs: the road show. Through nineteen presentations, and an equal number of question and answer sessions, and breakfast, lunch and dinner meetings with the most prized investors crammed into a punishing travel schedule, and all the while unable to wait until the next time a quiet phone call could be made back to their office to make sure the company continued to operate smoothly throughout their month long absence, through all of this Norred and Evans excelled as they told Micom’s story: Micom sells low cost, easy-to-use data communication products to minicomputer users. The market for connecting terminals to remote minicomputers was growing faster than 23% per annum, the market was only 14% penetrated and Micom holds a commanding 85% market share. As for Timeplex and Infotron, they targeted their statistical multiplexers to customers interested in networking, and therefore innovated their products to be feature rich. Micom emphasized low cost and ease-of-use: the “box business,” not networking. It was a story that sounded like music to investors’ ears. It was also a story meant to be easy to absorb and mentioned little of the Micro600 Port Selector.

On June 19, 1981, Micom Systems, Inc. went public at $30.00 per share, raising in excess of $25 million with a market capitalization of nearly $190 million.21

Norred and Evans were committed to the strategy of selling boxes and of not getting into the much more complex networking business. What they did not realize, however, was their new Micro600 Port Selector product, the dataPBX, would soon take them in directions challenging not only to their business strategy but their very existence.

- [17]:

(Norred: “I always swore, after having gone through ADS, that I never really wanted to be in the modem business.”) Evans persisted, however, and they agreed to test the waters by first selling modems integrated with other products. So just as they had OEM’d their product to Codex, GDC and Paradyne, they now elected to OEM modems from UDS, the firm specializing in OEM’ing modems to others. The Micro8000 Concentrator Modem was introduced in early 1981.

- [18]:

The other new project was the Micro400 Local Dataset; a substitute for a modem over short distances.

- [19]:

Frankel’s experience with DataPBX’s came from his time at Tran.

- [20]:

Gandalf had introduced the first dataPBX.

- [21]:

Both Norred and Evans sold some stock on the offering, Their remaining shares, valued at $30.00 per share, totaled $3.7 million and $2.1 million, respectively.