Chapter 2 - Background

2.2 The Institutions of Competitive Capitalism

The United States began independent life as a confederacy – an organization formed by strong sovereign member states and weak central, or national, powers – operating under the sovereign law, or rules, set forth in the Articles of Confederation that were ratified in 1781. From the start, the confederacy proved incapable of solving a number of problems. First, the Europeans’ divisive economic tactics were confounding the emergence of a domestic economy. Second, the individual states were abusing private property rights, stifling economic incentive. Third, the weak national government, without means to raise moneys of its own, proved impotent in solving any of the substantive issues facing the new nation, such as what to do about the continental debt, settlement of western lands, interstate commercial disputes, or needed financial infrastructure. Fourth, the United States was caught up in a world economy confronting the limitations of mercantilism. The rules of the Articles of Confederation were not proving effective.

Economic considerations were central to our Founding Fathers’ search for new sovereign laws to replace the Articles of Confederation.1 In 1786, those with property,2 despairing for their own futures and the future of their young country, convened in Annapolis, Maryland to discuss their shared fate. One action called for a convention to be held the following spring to redraft the nation’s constitutional law. Congress seconded the call. The Constitutional Convention held from May to September 1787 stands special in human history. The fifty-five delegates conceived, not without disagreement and compromise, new “rules of law” that would give rise to the world’s most successful democracy and economy.

Guiding the economic thinking of the Founding Fathers was a new voice, one that spoke out against the principles embedded in the hated mercantilism, the reigning economic ideology. Adam Smith ignited a revolution in economics with his Wealth of Nations, published the same year as the Declaration of Independence, 1776. Smith’s ideas appealed to the young Americans for many reasons, including the fact that he loudly and publicly condemned the colonization policies of Britain towards America. He considered the discovery of America to be one of the two most important events in history:3

To prohibit a great people….from making all that they can of every part of their own produce, or from employing their stock and industry in the way that they judge most advantageous to themselves, is a manifest violation of the most sacred rights of mankind.4

Smith also opposed government meddling in markets, and the granting of privileges and immunities to mercantilist monopolies, two issues over which the former colonists had waged war. In railing against the “sophistry,” “vulgar prejudices,” and “giddy ambition” of the mercantilist monopolists, Smith asserted the monopolists had to be resisted “to prevent the almost entire corruption and degeneracy of the great body of the people.”5 Criticizing the philosophy of equating a nation’s interests with those of only the propertied class – the privileged under mercantilism – he claimed no nation would be successful, if most of its people were “poor and miserable.” His call resonated with those having recently shed the yokes of political and economic suppression.

Mercantilism saw the world as having a limited amount of wealth. For a country to increase its wealth, which essentially meant its store of gold, it either had to have producing gold mines, or earn gold in trade satisfying “the demand of strangers.” Thus, societies were pitted against each other in competition, with one gaining only “at the expense of other societies.” The goal was “to sell more to strangers yearly than we consume of theirs in value,” and to produce those “things which now we fetch from strangers to our great impoverishing.”6

Smith’s vision was different. He viewed wealth not as a store of gold but as a “flow of goods.” It was a vision of creating wealth, not simply its transfer. His solution to creating wealth was to get out of the way of man’s drive to better himself and his natural propensity “to truck, barter, and exchange one thing for another.”7 This “natural liberty,” if unimpeded by governments and their creations, monopolies, would give rise to a system of perfect market competition. All that was required was “peace, easy taxes, and a tolerable administration of justice.”8 Smith wrote:

Every man, as long as he does not violate the laws of justice, is left perfectly free to pursue his own interest his own way, and to bring both his industry and his capital into competition with those of any other man, or order of men.9

Smith argued market competition would drive market prices to their natural prices – “the price of free competition.”10 As every man pursued his own self-interests, the good of the whole would be advanced – hence the famous dictum: the “invisible hand.” Smith’s vision must have seemed like home-spun, fireplace logic to the Founding Fathers, who were self-made men very much in keeping with the industrious individualism of Smith’s economics. “Laissez-faire” economics, although Smith never used that term to describe his views, captured the sentiments of the majority of those convened to write the Constitution – “private interest is a better patron of commerce and plenty, than the refinements of state.”11

While providing market competition as an alternative to government meddling and dominating monopolies, Smith’s views remained very much rooted in an agricultural economy, one of individual farmers – despite the industrial revolution happening all around him.12 To Smith, capital productivity came first and foremost from agriculture. Regardless, his philosophy became the needed justification of emerging capitalists who sought a logic to defend their desire to be left to their own devices.

Smith’s ideas appealed to both sides of the American political debate, the Federalists and Republicans,13 for each could read into Smith’s ideas their own beliefs. To the Federalists, led by Alexander Hamilton, Smith’s confidence in the individual, and the productive potential flowing from natural liberty, were exactly why they believed in the importance of protecting private property. The Republicans, led by Thomas Jefferson, on the other hand, saw in Smith’s arguments for small government reasons why the national government should be kept weak and powerless – and also why the threat of monopolies was best controlled locally, by the states. By providing a new theory of economic growth – market competition – to replace the tired and confining ideas of mercantilism, Smith had given the Constitutional Convention delegates the reasoning needed to keep government as removed from economic rule-making as possible. Protect private property and let it be freely exchanged. Then let experience provide the content needed for rules to have meaning.

The new Constitution discarded the confederate form of government in favor of Federalism – government with multiple levels, each independent, yet mutually dependent, and with each level’s restrictions self-enforcing, so one level can not overpower another14 – the famous checks and balances and multiple levels of government. The Constitution granted specific powers, or authority, to the Federal government, placed certain restrictions on the authority of the states, and all else was presumed to be either the right of the states or the people. Implicit in the design of this new sovereign law was an effort to keep government from ever becoming too powerful, or from the majority ever being able to trammel the rights of the minority – both abuses feared by private property owners who constituted a minority.

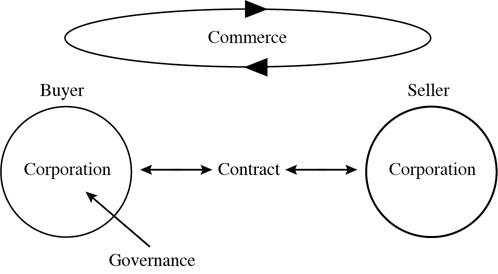

Of the many points of contact between the agent of the polity, government, and the working of the economy spelled out in the Constitution – taxes, tariffs, duties, intellectual property, private property, etc. – two clauses, or rules – commerce and contracts – proved essential to industrial capitalism.

Commerce represents the buying and selling among economic agents, along with the governing rules, that constitute a market. The commerce clause gave the Federal government a new source of authority with respect to the states. Authority was needed to end economic conflict between the states. Its brevity belies its economic potential:

Section 8. The Congress shall have Power….To regulate Commerce with foreign nations, and among the several States, and with the Indian Tribes;

Contracts are binding agreements that evidence exchange between economic agents engaged in commerce. The contracts clause differed from the commerce clause in an important way. It was not the source of a new power, but a restriction on existing state powers. (History will prove the contracts clause essential in protecting private property rights from state abuses,15 yet it almost did not make it into the Constitution, and was inserted at the very last moment after having been earlier rejected.16 ) Contract rights were critical for contracts evidenced title to private property and permitted its transfer. Again, the even briefer contract clause reads:

Section 10. No State shall..pass any…Law impairing the Obligations of Contracts,

In their succinctness, these two clauses leave vast opportunities for alternative interpretations: What do words like regulate, commerce, impair, obligation, and contract mean?, and How are they to be operationalized? With multiple interpretations also came alternative implementations and means of enforcement, choices which gave definition and meaning to American capitalism.

The Constitution was silent on the issue of corporations, leaving their creation and control up to the states. The primary means of state control was in the granting of charters that specified the “privileges and immunities” to be enjoyed by the corporations. The corporation charter defines the governance structure of corporations much as the Constitution defines the governance structure of the nation. (See Diagram 2.0 Institutions of Capitalism) Only rather than being a contract between the people and government, it is one between government and a private institution.

Once the Constitution was ratified by the needed nine states in the fall of 1788, elections were held, and the new government took office in early 1789. Among early acts were to levy tariffs on imports, pass the Judiciary Act of 1789 (to become as if part of the Constitution17 ), and enact the Bill of Rights with its ten Amendments; ratification by the states took until December 1791. One clause in Amendment V of the Bill of Rights will prove especially important to the institutions of industrial capitalism:

No person shall be…deprived of life, liberty, or property, without due process of law; nor shall private property be taken for public use, without just compensation.

The 1790’s proved to be a period for building financial infrastructure, including the institutions and organizations of money and banking, needed to effect market exchange.18 (The certificate of ownership in the first Bank of the United States – “scrip” – was first sold in early 1791 to raise $10 million. It soared in price from $25 to $30019 in a matter of months. Scrip was money created by the Bank of the United States.) The architect of these institutions and changes was Alexander Hamilton, the first Secretary of Treasury. He also issued a Report of Manufactures on December 5, 1791. Hamilton, felt strongly that a successful economy required domestic manufacturing;20 he had helped found the Associates of New Jersey Company earlier that spring, with a charter to “foster useful manufactures, deepen harbors, cut canals…”.21 His Report recommended a number of measures to promote domestic manufacturing, essentially nonexistent at the time,22 but Congress did not share Hamilton’s concern, and did nothing. The economy remained firmly agrarian with agricultural surplus exported and industrial goods imported.23

Exhibit 2.0 Institutions of Capitalism

Manufacturing may not have seemed important, but the same could not be said for state-based, internal infrastructure projects. In the 1790’s, the states began authorizing grants of privileges and immunities of corporations to create public projects for which the states had neither the moneys, nor competencies and abilities to effect – especially transportation projects, such as inland navigation, turnpikes, toll roads, and canals. These projects all required collective behavior, and to provide incentive for such actions, state legislatures created corporations, as only the law could do. They were known as “special-action franchises.24 Depending on the terms of the negotiated charter, one important incentive was the creation of private property to appeal to the self-interests of the people needed to effect collective action. From 1780 to 1801, the states chartered 317 corporations, nearly two-thirds for transportation projects, i.e. infrastructure, 20 percent banks and insurance companies, ten percent local public services (primaily water supply), and less than 4 percent industrial corporations.25

In 1800, in a tied election decided by the House of Representatives, Thomas Jefferson, a Republican, became President. The out-going Federalist President, John Adams, among his last acts in office packed the Federal courts with Federalists, including John Marshall, then Secretary of State, as Chief Justice of the Supreme Court. The Federalist controlled, lame-duck Congress conspired as well, passing legislation strengthening the Judiciary. The Republicans were furious. Jefferson began impeaching the most partisan judicial appointees, and Congress repealed the Judiciary Act of 1801. But the Federalists proved equal to the fight. At least John Marshall, who “hated Jefferson,”26 did. Marshall would become a dominant figure influencing the emergence of capitalism. His self-education reinforced his native beliefs in the principles of hard work and private property, and much like Hamilton, he strived to strengthen private property rights every opportunity possible.

On becoming Chief Justice of the Supreme Court, Marshall saw among his first tasks to strengthen the authority of the Court to interpret and enforce both Constitutional and enacted law; Marshall believed a strong Court could protect and extend property rights. Only he also knew Jefferson stood philosophically against a strong Court. How then to steer a course to a strengthened Court without causing a Constitutional crisis was his challenge. The vehicle was handed to him almost immediately when a Federalist-appointed judge the Republicans refused to seat filed a suit to secure his appointment.27 The case was Marbury v. Madison (1803) – one of the most significant cases in judicial history. In an act of “judicial statesmanship,” Marshall, in writing the opinion, gave Jefferson the court victory – the Judge was not seated – but in the process established forever the power of judicial review. Institutionally, the Supreme Court had seized the authority to enforce constitutional law, power never formally granted to it by law.28 Its implications prove profound.

In the early years of the nineteenth century, the courts began taking a more active role in commercial disputes. Until then, the courts referred “merchant” disputes to law merchant courts administered by other merchants, rather than by professional lawyers or judges – a form of self-regulation.29 In 1801, the New York State Supreme Court opined that it would no longer refer cases involving questions of law to mercantile arbitration. Then in 1807, the Massachusetts Supreme Court ruled that a private corporation could not coerce its members; in essence ruling that private corporations had to have internal contracts if they were to have the power and legal authority to enforce rules and settle disputes – contracts coming under the authority of the law. The reach of the court moved ever more assuredly into the commercial world.30

In 1805, the lack of domestic manufacturing became a crisis. Britain and France decreed new rules for international shipping, rules meant to severely limit what American frigates could carry. They took away a lucrative source of profits for the Americans, confiscated as many violating ships as they could, and asserted monopoly trading rights and profit-taking. In response, Jefferson, trying to end these decrees without going to war, ordered an embargo on all American trade with Britain and France. Only how were Americans to get the industrial goods they were becoming accustomed to?

New York State was among the first states to act, creating the School Fund in 1805 to incent local entrepreneurs to manufacture, or mine, essential industrial goods – such as textiles, glassware, paper making, iron implements, slate mining and evaporation of salt from brine.31 The School Fund was endowed with an initial grant of 500,000 acres of land,32 with the proceeds from their sale to be loaned to industrial entrepreneurs as three year notes, bearing six percent interest, and secured by borrower mortgages. Interest earned was to be distributed to the common school districts of the state. The School Fund represented government acting as venture capitalist to incentivize entrepreneurial activity, with the intent to invest, as guardian of the public good, in education.

In 1810, the Supreme Court ruled in Fletcher v Peck that state made, or signed, contracts carried the protection of the Constitution.33 Once created, the state could not take them away. Described as “a corner-stone of legal structure laid in mud”34 by one highly informed critic, it was an imaginative extension of the meaning of contract – contract rights preceded positive, man-made law, and were protected by natural law, and consequently a vested right35 – an argument first credited to Hamilton, and an important extension of Federal authority over the states.36 Marshall wrote:

“It may well be doubted whether the nature of society and of government does not prescribe some limits to the legislative power; and, if any be prescribed, where are they to be found, if the property of an individual, fairly and honestly acquired, may be seized without compensation?”37

The period from 1816 to 1824 was known as the “Era of Good Feelings.” A growing population, coupled with the resolved institutions of world trade as a consequence of the War of 1812, gave new energy to the emerging institutions of American commerce – the once all-purpose merchants, remnants of mercantilism, began giving way to specialized middlemen, for example.38 However, the economy remained predominantly agrarian. In 1820, crude materials, such as cotton and wheat, represented 60% of exports, while finished manufactures were 57% of imports.39 As would be expected, the population lived in the country, out of 9.6 million people, less than 5% lived in “places” of more than 8,000 inhabitants. Industrial manufacturing, other than that of textiles in the northeastern states – Lowell, Massachusetts for example – existed as home production, with factories, the production units of capitalism, a feature of the future. For now, people worked where they lived.

Population growth and the abundance of natural resources were fundamental forces driving economic growth. Population growth also brought urbanization, which forced new forms of productive life, such as factory production, which will sow the seeds and become transformed into mass production. (See Exhibit 2.0 Population and Land Statistics 1790-1920)

But before factory production could emerge, two institutional changes were needed: corporations had to have Constitutional protection, and the freedom to conduct interstate business.

Before 1819, it was unclear if the states had police powers rights to void contracts they had made. If they could legally rescind prior grants of incorporation, they could take away a corporation’s assets. Wasprivate property held in corporate name protected under the Constitution? Since the word corporation appears nowhere in the Constitution, the answer was uncertain. Again enter the Supreme Court with Dartmouth College v Woodward (1819).40 In an epic decision, state-granted charters were ruled to be contracts, and thus could not be impaired by subsequent state act. Corporations did come under Constitutional protection. Even though the Court decision concerned a charter granted by the King of England, long before the Constitution ever existed, and concerned an educational organization, it was understood to apply to state granted corporation charters.

Exhibit 2.1 Population and Land Statistics 1790-1920

| Census Date |

Population (in millions) |

Land Area (millions of square miles) |

Persons per Square Mile |

Population in Places of 8,000 Inhabitants or More |

Annual Population Growth Rate |

|---|---|---|---|---|---|

| 1790 | 3.90 | 0.90 | 4.5 | 3.30 | |

| 1800 | 5.30 | 0.90 | 6.1 | 4.00 | 36% |

| 1810 | 7.20 | 1.70 | 4.3 | 4.90 | 36% |

| 1820 | 9.60 | 1.70 | 5.5 | 4.90 | 33% |

| 1830 | 12.90 | 1.70 | 7.3 | 6.70 | 34% |

| 1840 | 17.00 | 1.70 | 9.7 | 8.50 | 32% |

| 1850 | 23.20 | 3.00 | 7.9 | 12.50 | 36% |

| 1860 | 31.40 | 3.00 | 10.6 | 16.10 | 35% |

| 1870 | 39.90 | 3.00 | 13.4 | 20.90 | 27% |

| 1880 | 50.20 | 3.00 | 16.9 | 22.70 | 26% |

| 1890 | 62.90 | 3.00 | 21.2 | 29.00 | 25% |

| 1900 | 76.00 | 3.00 | 25.6 | 32.90 | 21% |

| 1910 | 92.00 | 3.00 | 30.9 | 38.70 | 21% |

| 1920 | 105.70 | 3.00 | 35.5 | 43.80 | 15% |

Source of Data: Business Annals by National Bureau of Economic Research Inc. 1926

As a consequence of Dartmouth College, corporation rights under state charters became more certain, and thus their use began to increase.41 Even so, the states still very much controlled what rights corporations had, and, by simply inserting in the charter that the state reserved the right to change charter terms at any time, they could effectively circumvent Dartmouth College. Examples of how states maintained control in charter grants were: what businesses the corporation could engage in, how long it was authorized to exist, how much money it could raise (capitalization), the price per share of its stock (par value), how much debt it could have, how management decisions were made, whether it was tax-exempt or not, and whether it had rights of eminent domain or monopoly.

In addition to the tight control states exercised over corporation charters, two other disincentives discouraged corporation use: corporations required special state legislation, and they provided no, or extremely little, liability protection for shareholders. To secure a corporation charter, shareholders needed a state’s legislature approval; a very political act, and one latent with favoritism and abuses. Many prospective enterprises that might have benefited from incorporation were deterred from seeking it by having to run the political gauntlet. The second disincentive effected non-management shareholders, and through their non-action, management. Shareholders retained unlimited liability, yet they had little say in what liabilities the corporation was incurring, or how they were being discharged. Consequently, they had little incentive to invest capital in manager-owned corporations. Marshall’s description of a corporation in Dartmouth College v Woodward remained true until the mid-1880’s:

“a corporation is an artificial being, invisible, intangible, and existing only in contemplation of law.”

Little reason existed to improve the benefits from incorporating for the scale and scope of market exchange remained essentially local; hence, businesses were small with no need to expand. One way for markets to grow was to conduct commerce over expanded distances, but that meant dealing with strangers and transacting under different state laws – laws meant to keep out “foreign” corporations. This transition from personal to impersonal markets was inevitable, however, both because of the propensity of merchants “to truck, barter, and exchange one thing for another,” and because technological innovations were forever improving transportation and communication systems. Technological innovation drove economic growth by extending the reach of markets.42 As impersonal, i.e. distant, markets became increasingly important, existing uncertainties in the institutions of commerce and contracts needed resolution.

In the early 1800’s, a new technology driving market expansion was the steamboat, which in turn forced changing rules of commerce. Again, enter Marshall, this time with the legendary “Great Steamboat Case.” In 1824, the Supreme Court ruled in Gibbons v Ogden that the states could not obstruct interstate commerce. The case concerned whether New York State had the power to grant a monopoly “over navigation by fire or steam on all public waters within the boundaries of the state.” In 1789, the New York State legislature confiscated exclusive rights it had awarded only two years earlier in order to transfer these monopoly rights to the colonial hero, Robert R. Livingston, and his partner, the self-described inventor of the steamboat, Robert Fulton.43 (Livingston was a Republican benefactor and the legislature was under Republican control, proving that state abuses of private property survived the adoption of the Constitution.) Livingston had the money and connections, Fulton, the entrepreneurial energy and mastery of the new technology. Yet Livingston would only act as venture capitalist if he and Fulton had no competitors.44

In August 1807, Livingston-Fulton’s Clermont successfully steamed up and down the Hudson River between New York and Albany. Immediately, a series of legal challenges were filed contesting the power of the state to grant private rights through exclusive franchise when the use of public waters was a common right. On appeal to the Supreme Court, Marshall, writing the opinion, “voided” the New York grant and in so doing created the doctrine of “dormant” power – Congress had the exclusive power to regulate commerce, whether it used it or not, and any state legislation to the contrary was void.45 The Court also broadened the definition of commerce to include transportation – a decision important to future communication technologies – and reaffirmed its right to enforce the nationalization of the country, and commercial markets, over the rights of “member states.”46

Gibbons v. Ogden proved to be Marshall’s last judicial victory in a major commercial or contract case. In 1827, in Ogden v Saunders, the Court opined, over Marshall’s objection, that prospective bankruptcy laws were constitutional, states gave meaning to contracts not those making the contract.47 Marshall’s unswerving belief in the natural law of contracts – “Individuals do not derive from government their right to contract, but bring that right with them into society” – no longer carried the day, and so ended his efforts to extend constitutional protection to contracts.

As important as the courts had become in reading a favorable interpretation of contract law for commerce, and thus strengthening an enabling institution of capitalism, the courts were not alone. The growing importance of market exchange confounded the traditional “title” theory of contracts and its assumption of “customary” prices – under which contracts simply evidenced title and, if disputes arose, juries decided fair prices irrespective of contract terms.48 Beginning as early as 1822, contract theorists began writing that markets and speculation were constrained under the title theory, and contracts should be decided solely by the “will” of the parties. By 1844 with the publication of William W. Story’s Treatise on the Law of Contracts, the meaning of a contract, driven by theory and confirmed by court decisions49 , had been transformed from one of title to wills – “Every contract is founded upon the mutual agreement of the parties.” The will theory placed contracts largely outside the influence of the polity to rule what could or could not be contracted.

The movement toward national markets and strengthened Federal powers led by Marshall slowed in 1835 with his death. The populist President Andrew Jackson, who believed in a strict constructionist interpretation of the Constitution – the supremacy of state power – appointed Roger Taney as the new Chief Justice in 1836. Taney’s belief in state powers would not mean he was anti-commerce however. In Proprietors of The Charles River Bridge v. Proprietors of The Warren Bridge (1837), the Court ruled that the state of Massachusetts need not be constrained by a previous grant (contract) of monopoly powers when time and circumstance, i.e. the public good, required new contracts to sustain economic competition and growth:50

While the rights of property are sacredly guarded, we must not forget that the community also has rights, and that the happiness and well being of every citizen depends on their faithful preservation.51

In 1837, the Jacksonian revolution’s philosophy that all would be fine if government stayed out of people’s way ran into the realities of integrating markets and technological change. In late March, news from New Orleans of declining cotton prices punctured a speculation bubble that led to financial panic and, by May, a full scale depression.52 In 1837 alone, six hundred and fifty banks failed.53 Martin Van Buren, the new “Jacksonian” President did nothing, believing domestic economic matters were best left to the states. Laissez faire economic policy was also challenged by the growing problem of steamboat disasters – in 1830, for example, 1,500 people were killed by steamboat boiler explosions.54 Congress proved reluctant to interfere with commerce, and steamboat operators proved equally unwilling to cooperate and make travel safe. The problem persisted and, finally, in 1838, a modest boiler and hull inspection program was enacted. The Federal Government, having been mandated a role in steamboat practices by the Supreme Court – Gibbons v. Ogden – had to do something for not acting meant no change and more deaths. And then there were all the local groups that wanted Federal and state government support for the latest “internal improvement” – the railroads – similar to prior advances in transportation, i.e. canals, toll roads, etc. Laissez faire economic policies, so appropriate for an agricultural economy, seemed out-of-step with a struggling to-be-born industrial economy.

The role of the corporation remained to be decided. In 1839, in Bank of Augusta v Earle, the Supreme Court ruled on the rights of corporations to do business in states other than the one of their incorporation. As if a plea to good manners, the Court opined that the principle of comity55 meant foreign corporations had presumed rights to do business in a state unless the state adopted clear rules of exclusion.56 Yet, consistent with a strict constructionist’s interpretation, if a state wanted to exclude foreign corporations, they had the power to do so. The Court also made clear that corporations were not “citizens,” but “artificial persons,” and did not enjoy the privileges and immunities guaranteed in Article IV of the Constitution57 – that the citizens of each state shall be entitled to all privileges and immunities of citizens in the several states. The Court confirmed Marshall’s description of a corporation as “an artificial being, invisible, intangible, and existing only in contemplation of law.”58 The only basis of a corporation’s legitimacy was its state charter – where that charter was not recognized by law, the corporation simply did not exist.59

In 1842, both Congress and the Supreme Court acted to foster national commerce – both influenced by a then five year old depression. Congress tried by funding the development of the telegraph, while the Supreme Court contributed by improving the rules of commerce.

- [1]:

Charles A. Beard,An Economic Interpretation of the Constitution of the United States pp.??? Daniel Webster in arguing before the Supreme Court said: “Over whatever other interests of the country, this government may diffuse its benefits and its blessings, it will always be true as a matter of historical fact, that it had its immediate origin in the necessities of commerce; and for its immediate object, the relief of those necessities, by removing their causes and by establishing a uniform and steady system.” Franklin D. Jones, Historical Development of the Law of Business Competition. Yale Law Review, ca. early 1927

- [2]:

The private property interests bringing the “Federalist” together were as: merchants and manufacturers, speculators in western lands, holders of continental debt, and money lenders. Beard,Economic Interpretation, pp. ?

- [3]:

The other being “a passage to the East Indies by the Cape of Good Hope.” Adam Smith,An Inquiry into the Nature and Causes of the Wealth of Nations(1776; Amherst, NY: Prometheus Books, 1991) pp.??? See also Bert F. Hoselitz, ed..,Theories of Economic Growth 72-3.his essay, or anothers?

- [4]:

The Wealth of Nations 1937, p.576,Is this Pg right? T. W. Hutchison,On Revolutions and Progress in Economic Knowledge pp.???

- [5]:

Smith..pp???David McNally,Political Economy and the Rise of Capitalism:A Reinterpretation 212-3.

- [6]:

Thomas Sowell,Classical Economics Reconsidered 9.

- [7]:

**Hoselitz,Economic Growth, 66.

- [8]:

Ian Simpson Ross,The Life of Adam Smith 272.

- [9]:

WN 2:687 McNally,Political Economy, 225.

- [10]:

McNally,Political Economy, 225.

- [11]:

McNally,Political Economy, 171-2.

- [12]:

**Hiram Caton, “The Preindustrial Economics of Adam Smith,” Journal of Economic History 45 (December 1985):835. “That theWealth of Nations contains no recognition of the industrial revolution is unequivocally asserted” by R Koebner in “Adam Smith and the Industrial Revolution.” Economic History Review, 11 . pp. 381-391 input

- [13]:

Need dates of party naming??????????? also, not the repubs: the Democratic Republicans.

- [14]:

Barry R. Weingast, “The Economic Role of Political Institutions:Market-Preserving Federalism and Economic Development,” Journal of Law and Economics11, :1.”Thriving markets require not only the appropriate system of property rights and a law of contracts, but a secure political foundation that limits the ability of the state to confiscate wealth.” Weingast argues for a form of federalism called market-preserving federalism that is characterized as both hierarchical and self-regulating, as well as with the substates, who have financial constraints, controlling the economy as a member of a common market.

- [15]:

Benjamin Fletcher Wright, Jr.,The Contract Clause of the Constitution 95. “Before 1889 the contract clause had been considered by the Court in almost forty per cent of all cases involving the validity of state legislation. So successfully was its protection invoked that it was the constitutional justification for seventy-five decisions in which state laws were held unconstitutional, almost half of all of those in which such legislation was declared invalid by the Supreme Court.”

- [16]:

The contract clause had been struck from an early draft of the Constitution. History is unclear as to whether it was the Northwest territories contract signed by Congress in the intervening period, or whether a compromise with those wanting the Constitution to remain silent on the question of slavery that cause the clause to find its way into the final document.

- [17]:

Benjamin F. Wright,The Growth of American Constitutional Law 27.

- [18]:

Without money, the forming market economy was constrained to barter, where every buyer had to find the appropriate seller, and the seller had to want what the buyer was selling. Money broke this doubly binding constraint. Every buyer and seller could first exchange for money, and then use money to effect exchange with anyone else. In the 1790’s, a surge of banks formed in response to the economic opportunity in the need for currency to finance a wanting-to-happen market economy.

- [19]:

Davis, Essays, 203.See this essay for an excellent history of this period.

- [20]:

Davis, Essays, 270-272

- [21]:

Harold W. Stoke, “Economic Influences upon the Corporation Laws of New Jersey,” Journal of Political Economy38 :552.

- [22]:

Alice Hanson Jones, “Wealth and Growth of the Thirteen Colonies:Some Implications,” Journal of Economic History44 :210.

- [23]:

In 1800, 83% of the American workforce was in agriculture. Thomas C. Cochran, “The Business Revolution,” American Historical Review 79 :1451.

- [24]:

James Willard Hurst,The Legitimacy of the Business Corporation in the Law of the United States, 1780-1970 20.

- [25]:

Hurst, Legitimacy, 17

- [26]:

Max Lerner, “John Marshall and the Campaign of History,” Columbia Law Review? :406.See article for full details.

- [27]:

Ironically, Marshall’s lapse as out-going Secretary of State gave rise to the suit.

- [28]:

Lerner, Marshall, 409.”In these decisions the reasoning of Marbury v. Nadison and the increased strength and prestige of the Supreme Court worked powerfully. Marshall's role in this entire process was to give judicial review a foothold, use it for the immediate interests of the capitalism of his day, tie it up with the powerful appeal of nationalism, and entrench it where a later stage of capitalism could take it up and carry it further for its own purposes.”

- [29]:

Lurie,RutgersLaw, pp. 1112-1116

- [30]:

**Indicative of this active judicialism, throughout the nineteenth century, contract and commerce cases represented X% of all Supreme Court cases.

- [31]:

Ronald E. Seavoy, “Laws to Encourage Manufacturing:New York Policy and the 1811 General Incorporation Statute,”Business History Review156 :pp. 88

- [32]:

Seavoy, Manufacturing, 87.

- [33]:

Lerner, Marshall, 411.”Sir Henry Maine once said that the progress of society is from status to contract:FN if that is true, Marshall must rank as one of the great heroes of humanity, for he gave contract a sanctity overriding every consideration of public policy or economic control. Next to judicial review itself this conception of contract – broadened into a doctrine of “vested rights” FN – is probably the most important invention in the history of the Court.”

- [34]:

Lerner, Marshall, 412.

- [35]:

Wright, Jr.,Growth, 42-3.

- [36]:

Wright, Jr.,Growth, 31-2.

- [37]:

Wright, Jr.,Growth, 32.

- [38]:

Freyer, Forums, p. xvii

- [39]:

Business Annuals, p. 111

- [40]:

See especially Francis N. Stites, “Private Interest & Public Gain: The Dartmouth College Case, 1819.”

- [41]:

Ibid, p. 101.”In…ruling that the charter of Dartmouth College, in which the state had a considerable interest, was private property, Marshall was saying that a public interest in the objects, the uses, of private property was insufficient ground for state interference. Protection of private vested rights would better serve the public interest.” Also, “A vested right is a legal claim to ownership which comes to exist or “vest” in one party through a legitimate contract with another.” p. 153

- [42]:

Given that the polity has responsibility for the economic welfare of the public, it is small wonder questions of public interests arise with virtually every significant improvement in transportation and communications.

- [43]:

W. Howard Mann, p. 151 Also from Joseph Dorfman, “The Economic Mind in American Civilization 1606-1865, Volume 1,” Quoting from pp. 472-3:”Fulton’s was a versatile and lively mind. For a while he painted portraits and minatures without shining success. It is hardly surprising, therefore, to meet him in 1796 trying to “sell” to the British government and private men the idea of cheap canals to provide “easy communication with the marts of trade.” In a book published in that year he elaborated an economic analysis drawn from Adam Smith and other more or less popular writers to show how his particular schemes would promote the wealth and power of England…..It is natural to find him arguing that cheapening communication would promote enterprise and thus increase the common stock of the nation and fully develop its resources. The main argument was that canals, as compared with roads, save manual labor in construction, maintenance, and use. But, while reducing labor costs, canals multiply produce and thus in turn increase population, which, by creating a greater demand, pushes improvements to a higher spiral…….Of course, the great lock canal companies, he argued, would immediately fly to Parliament and demand restrictions on the ground of protecting their investments and the value of affected mill and land property. A wise legislature, however, knows that competition is “the true polish of society.” It always takes as little profit as it can afford, but “monopoly as much as it can draw.” Competition, therefore, should be encouraged , restrictions should be as few as possible, and “circulation be as free as the air we breathe.”” Nevertheless, Fulton still sought a monopoly for steamboats.

- [44]:

Ibid

- [45]:

Lerner, p. 428

- [46]:

Ibid, p. 224

- [47]:

Harry N. Scheiber, “Federalism….”, p.76 Also, Wright, “Contract Clause…,” p. 50:”If hispoint of view here had been that of the majority, the decision, unless later reversed, would have been as great a limitation upon state legislative power as any of his period, perhaps the most sweeping.”

- [48]:

Horowitz, ChapterVI

- [49]:

Kevin M. Teevan, “A History………..” p.188 “What was lacking earlier was a throbbing market economy in need of the support and stability provided by the courts. Once judges saw the benefits to the nation and to commercial interests of an activist posture supportive of the free market, the ideas of will theory and political economy were available to rationalize an instrumental approach.”

- [50]:

Scheiber, p. 80 Also Teeven “A History……..”, p. 189”Now when vested property rights were monopolistic, they would be subservient to policy favoring competitive uses of property.”

- [51]:

Felix Frankfurter, “Taney…….” p.1301

- [52]:

This panic can be seen to be aggravated by the delayed communications between New Orleans and the eastern cities. New Orleans also gave the example of General Jackson’s defeat of the British two weeks after the War of 1812 had been concluded.

- [53]:

Robert Sobel, “The Big Board,” p. 48”Bank note circulation, which had reached $149 million before the crash, dropped to $58 million by 1843.”

- [54]:

Leonard D. White, “The Jacksonians,” p. 442

- [55]:

Freyer, p. 93”A principle holding that mutuality of interests among the states should govern certain decisions.”

- [56]:

Scheiber, p. 77 Also see Hurst, “The Legitimacy….”, pp. 64-65

- [57]:

Ibid., p. 77

- [58]:

Schreiber, p. 77 Mike need citation

- [59]:

Alton D. Adams, “State Control of Trusts,” p. 465 Quoting Chief Justice Taney:”It exists only in contemplation of law, and by force of law; and where that law ceases to operate, and is no longer obligatory, the corporation can have no existence. It must dwell in the place of its creation, and cannot migrate to another sovereignty….We think it well settled, that by the law of comity among nations, a corporation created by one sovereignty is permitted to make contracts in another, and to sue in its courts…But we have already said that this comity is presumed from the silent acquiescence of the state. Whenever a state sufficiently indicates that contracts which derive their validity from its comity are repugnant to its policy, or are considered as injurious to its interests, the presumption in favor of its adoption can no longer be made.”