Chapter 7 - Data Communications: Market Order 1973-1979

7.12 Micom: Meteoric Success and Competition 1978-1979

Within weeks of the Micro800 Data Concentrator announcement in January 1978, Ed Botwinick, President of the struggling Timeplex, called saying he was in the neighborhood and wanted to visit. Evans remembers:

Ed Botwinick came by to say he had heard about our product and it certainly sounded very interesting. Of course, it was very unfortunate that we had no sales and marketing capability, and, therefore, we were really going to have a hard time doing justice to this product – but he had the perfect solution. We said that we did have a pretty clear understanding of how we were going to take this product to market. In considerable irritation, he then moved into threat mode – that if we wanted to have Timeplex compete directly with us, then I’m afraid that was the way it was going to be.

Botwinick remembers:

I wanted to buy them. They had announced their product and we had not yet announced our Series I. I told them about it and I figured it might shake them a little bit, but they decided to go their own way.

Norred and Evans had expected competition. What the competitors did not anticipate, however, was that the combination of having no money, no installed base of customers or committed channels of distribution, and a high degree of confidence in knowing who would be buying their product caused Micom to introduce something far more than simply a very clever product. They innovated an entirely new way of marketing and selling data communication products.

That prior fall, when Norred and Evans made the data concentrator the focus of Micom, they agreed their ship-and-use statistical multiplexer would be sold to minicomputer users through broad-based distribution. A $2,000 list price provided for both a 40% discount to the channels of distribution and a healthy gross margin for Micom. Evans remembers the problem of creating credibility given their product strategy:

Timeplex had been in the business for years and was nowhere close to shipping a product it had been claiming it was going to deliver for two years. This is a grave – GDC had done exactly the same. Codex was the only guy out there, and they were losing money because it had proven to be a much taller order than they realized. And we were going to come out with a product at TDM prices and we ran the risk of having people laugh at us, just kill themselves laughing, that some start-up comes out with a product that offers all this capability for no money – you’ve got to be crazy.

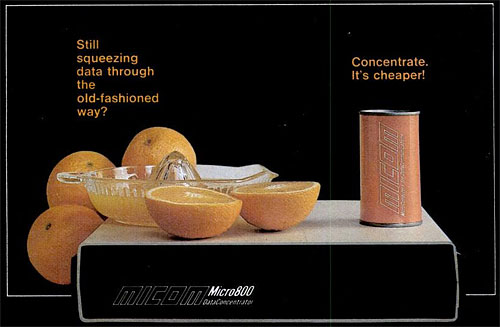

To overcome market disbelief, Evans invested his entire year’s budget in a product brochure: “so quality and Fortune 500 in its feel, that nobody could even question that this company was for real.” A photograph of an orange juice can next to an orange was the cover shot:

the orange being the old fashioned way to start your day, and the concentrate can being the new, efficient way to get your orange juice in the morning. Hence the analogy: the old fashioned way of transmitting data being the orange and the new fangled way, or the efficient new way, being the concentrate in the can.

It was a ton of money, but it had to be, so Evans spent the money on the brochure:

And within six months, almost everywhere I went, people would say: ‘Oh, you’re the guy from the orange juice company.’ The oranges made an incredible impact because, for a company in our kind of business, it was unheard of to do that kind of thing. So it became a fundamental part of Micom and what we stood for.

Exhibit 7.12.0 Micom Micro800 ad in Computerworld Nov 12, 1979

Micom also held product seminars for buyers, not “techies.” It proved a winner, broadcasting Micom’s success as if inviting competition.

Infotron responded first, just as they had to Codex. In early 1978, an Infotron customer, Bank of America, showed Dambrackas, director of multiplexer engineering, a Micom Data Concentrator. On seeing the “little plastic box you could put in an attaché case,” he thought it “cute” but wondered: “Why such a small number of channels?” Not posing any competitive threat to Infotron’s products, he quickly forgot about it. But not for long, for it soon seemed as though every conversation ended up involving Micom and their strange little plastic box. Dambrackas bought a couple. In playing with them, he soon “got very excited,” and saw ways to make improvements – largely from using the recently introduced Motorola 6502 microprocessor. In December 1978, Infotron introduced their Supermux 480: four channels for $1,725 and eight channels, $2,725. They didn’t, however, change their distribution or marketing practices, simply listing the Supermux 480s in their standard product catalog; revealing they saw only the technology and not the important new market of results-oriented minicomputer users opening up – users who did not buy data communication products in the then traditional manner.72 Infotron would not be alone in making this mistake. By mid-1980, six other firms would announce low priced statistical multiplexers – none would impact Micom’s market dominance.

Micom’s sales nearly doubled to $1.5 million in 1978 and then grew an astonishing 250% in 1979 to $5.3 million. By 1980, Micom’s sales of $15 million equaled those of the two leading multiplexer companies: Timeplex and Infotron. Norred recalls:

The growth of the Data Concentrator was so far beyond our expectations. We ran for almost three years trying to figure out ways to get manufacturing big enough to deal with the orders.

Norred and Evans made yet another critical, and prescient, decision in mid-1978 when they decided to OEM (Original Equipment Manufacturer) the Data Concentrator to other data communication firms. Evans remembers their strategy:

to get our volume up so fast that we would get down the cost curve just on a volume basis to where we’d be untouchable because we exploited the lead in the market. We also were convinced that we were clearly going after a target market that had never heard anything about Codex or GDC or Paradyne, and that those guys could take product from us and it would be totally incremental to what we’d be sending through our channels.

Codex introduced products OEM’d from Micom in July 1979; as did GDC later that year. Paradyne would follow in 1980. (In 1980, one-third of Micom’s sales would be OEM.)73

By 1979, Micom’s strategic focus on dominating low-cost statistical multiplexers appeared to be working like a charm. They held an amazing 80% market share. However, some critics questioned whether Micom was missing out on the emerging demand for networking systems. Evans’ characteristic response to Micom’s critics was:

We may be unique in the business today with no systems orientation. Some say it’s our fatal flaw but I prefer to think we know something they don’t.74

In sharp contrast to past experience, Micom’s meteoric success had venture capitalists pounding on their door, begging the company to take their money. However, Micom didn’t need money; tight fisted expense management, exceptional profitability – in 1979 pre-tax profits were 27% of sales – and the ability to dictate terms of sale to its channels of distribution, all helped minimize cash requirements.

Hovering around the company as well were other companies with designs on acquiring Micom. Dave Goodman, one of the outside directors of the Board, sensed that Norred and Evans might be tempted to sell the company prematurely, or would become gun-shy of growing the company aggressively for fear of risking their existing paper capital gains. He proposed they sell some of their stock to eager-to-invest venture capitalists. Goodman also argued that if Micom ever sold stock to the public, they would benefit from the advice and cachet of venture capital investors. Norred remembers:

The driving force, as much as anything, wasn’t to bring money into the company. It was so Roger and I could both sell some stock and put a little away before we screwed the company up. There was also an element of listening to people – it would be important to us to get other people involved that could help us.

In November 1979, Micom sold 796,000 shares for $3.021 per share; the company raised just shy of $1.6 million and the selling shareholders received nearly $800,000. Micom’s new market value: $16.6 million. Three years earlier the company had been valued at less than $500,000. On paper, Norred and Evans were multi-millionaires.

The financing changed the conservative management style of Norred and Evans in two important ways. First, in allowing each to take some of their money off the table, they no longer lived under the threat of losing everything if Micom’s fortunes declined; in fact, the moneys already received were close to their original hopes/expectations. As a consequence, they became motivated to make their remaining shares worth as much as possible, including growing Micom large enough to go public – a goal reinforced by the new venture capital shareholders. A second effect of the financing was to further reduce the risks of either the company running out of cash or being unable to finance accelerated growth. They could also afford the expenses of additional management, management needed to free Norred and Evans to concentrate on strategy and growth. One of the first acts was to initiate a search for a Vice President of Engineering so Norred could focus on being President.

- [72]:

Evans: “We hadn’t done anything that, once people could look at our box and see what we had done, it wouldn’t be that tough for them to emulate it. In fact, everybody that did try to emulate it was stupid enough to look at our list price and say: ‘Hey, we could make a lot of money doing that.’ Our planning was always base on 40 off list, because that was what we expected to get for our boxes. Everybody that came in told their engineers to build a product where they could make their margin at list, which is why nobody ever came close, from a product cost standpoint, to meeting what we had done.”

- [73]:

Prospectus of June 19, 1981, p.15

- [74]:

Electronic News, March 26, 1979, p. 36