Chapter 2 - Background

2.7 Vail Joins the Bell Telephone Company -- 1878-1887

Knowing from the February 1878 financing that a condition of any new investment would be the hiring of a full-time general manager, Hubbard thought at once of Theodore Newton Vail. Hubbard, now a Congressman from Boston and a member of the Congressional Postal Committee, had met Vail during a cross country inspection tour of the mail system. Vail, the General Superintendent of the Railway Mail Service,283 had led the tour and was as impressive as his reputation would have him. When Hubbard, the consummate promoter, pulled out his two telephones, which he would do on every possible occasion, Vail immediately grasped their transformative potential – as would the man needed to build the telephone business.284 On their return to Washington, Hubbard had two telephones sent to Vail’s home, where he not only used them, but began promoting the prospect of their boundless future.

As a child, Vail (1845-1920) knew by heart the story of Alfred Vail, his cousin once removed, Samuel F. B. Morse’s partner and chief technical collaborator.285 Vail’s father even managed the Speedwell Iron Works, the very place where Alfred had built Morse’s original telegraphs.286 Vail gravitated to the telegraph as well. His first job was working in the local drug store, which also happened to be the local telegraph office. Before long he knew more about telegraphy and building telegraphs than he did drugs. At nineteen, his uncle Issac Quinby secured him a job with WU in New York city.287 In the diary he kept, he displayed a young man caught between his moral sense of duty and his self-indulgent instincts: Staying up late of nights playing Billiards and drinking lager is not what young men should be doing and for one I am determined to stop it.288 Intentions proved easier than practice, and with his career seemingly going no where, he moved with his family to Waterloo, Iowa in 1866.

However, farm life was not for Vail. On learning of telegraphic opportunities out West, he left to become the night trick with the Union Pacific Railroad in Wyoming.289 Then in 1869, Uncle Quinby came through again, and Vail was appointed a clerk with the Railway Mail Service. It proved the opportunity he needed, and he excelled. In 1873 he was promoted to headquarters in Washington D. C. There he revolutionized the processing of mail, dramatically improving service. In 1874, he became Assistant General Superintendent and in 1876, General Superintendent. As his finances improved, he began to invest in patents, always hoping to find one with the potential of the telegraph. His dream of future riches and influence differed from than his job, which was became more bureaucratic, more political, and less to his liking. His tolerance was exceeded when a Congressional hearing in early 1878 spent a day discussing the cost and appropriateness of his $5 a day per diem. Within days he told Hubbard he was ready to join the Bell Telephone Association, which he did in late June. When the news got out, most people were astounded – why would he throw away his career on another fantasy of Hubbard’s? One Congressman wrote Vail: Don’t rob the public of an invaluable servant just because we tried to cheat and starve you.290 His boss wrote to him: Listen to the prophesy of an old fool to a friend. One or two years hence there will be more Telephone companies in existence than there are sewing machine companies today.291 So just as Morse’s MTC had hired Kendall from the Postal System, so did Graham with Vail. (Vail will become the most dominant force in Bell’s history.)

Vail inherited a desperate situation as the new general manager of the Bell Telephone Association. With every passing day it seemed more certain that the aggressive tactics of the colossus WU-AST would sink their struggling start-up. If that were not enough, Hubbard’s part-time, half-informed management practices had created such a mess within the organization, that if it did not collapse from external forces, it would implode from internal chaos. Without sufficient resources, and being stressed in more ways than imaginable, Vail needed to act fast and competently, for there was little chance he would have the opportunity to fix what he got wrong.

First he had to contain, and hopefully reverse, the train wreck being created by WU-AST. To the morally inclined Vail, the fact that WU-AST was acting with total disregard of the Bell patent rights infuriated him, and gave him the strength of a cornered animal. Immediately he wrote to every agent to strengthen their competitive resolve:

We have the only original telephone patents. We have organized and introduced the business and we do not propose to have it taken away from us by any corporation.292

Within weeks WU-AST announced a new telephone incorporating the transmitter innovated by Edison. Known as the “plumbago,”293 or “carbon button,” it significantly outperformed Bell’s hammered metal diaphragm in transmitting speech. WU-AST wasted no time in pressing its new advantage.

Where WU-AST, like the Robber Barons that so influenced WU history, could not bully an agent into abandoning efforts, they tried to buy them out. In the two critical markets of New York City and Chicago the agents gave up. As added inducement for Vail to come aboard, he had been named the new agent for New York City. (One of his early acts as general manager was to grant the agency for Chicago to some friends.) Vail invested what little money he had, and could raise from friends, in the newly organized Bell Telephone Company of New York (BTC-NY). For it was in the latter that Vail had his equity ownership,294 not the parent organization – even though he was its general manager. Holmes, of the burglar alarm and switch, was made president of BTC-NY; Charles Williams became an investor.

In July, some of the immediate financial pressure eased with the incorporation in Massachusetts of the Bell Telephone Company (BTC). Capitalization was $450,000, although only $50,000 was new cash. It was assigned all the Bell patent rights outside New England. The investors had equal representation on the Board of Directors even though they had invested only $25,000; Sanders invested the other $25,000. An Executive Committee was also created, with Hubbard but one of three members. Vail became the full time general manager.

With the creation of NETC, BTC-NY and now BTC,295 the fundamental structure of the Bell companies began assuming form. No longer was it a patent association that licensed agents and leased them telephones. Rather, the patent holders had transformed, or, more accurately, been transformed, into shareholders in two corporations: NETC and BTC. These two corporations, as holders of the patent rights, now licensed agents, and, in a new twist, took stock in the agents corporations – as they did with BTC-NY; Hubbard had agreed, on his own,296 to provide financing for BTC-NY in exchange for stock ownership. The financial return to be earned for holding the patents was now dividends, not a percentage of the lease payments. A holding company form of organization had been created, only without the company(s) holding the stock, for they couldn’t legally – it was 1878, four years before the Standard Oil Trust.

Only weeks aboard and with the finances seemingly under control, Vail now had to bring order to chaos. Much of it would come simply from the hand of a good, full-time general manger. But he also needed a coherent strategy to guide and inform his actions. By experience and vision, he agreed with Graham’s grand system. First the patent rights had to be asserted – and successfully. Then came building a company by 1893-1894 substantial enough to withstand the competition that would surely emerge when the patent rights expired. A competitively robust Bell was thought to consist of viable exchange services in all the major markets, interconnected with a long distance network. If accomplished by 1894, any competitor would have to build local switch services against entrenched competition, as well as find a way to offer integrated long distance calling. By having the grand system in place, effective competition would have to be national in scope, which would significantly raise the costs and risks of potential competitors. However, such a vision was a long way from reality as BTC was just then shipping its first modest switch, and the maximum distance of a long distance telephone call was in the tens of miles.

In September 1878, Bell – BTC and NETC – filed a patent infringement lawsuit against the Boston agent of WU-AST, Peter A. Dowd. In the same month. Vail acquired the patent rights to a transmitter developed by Emile Berliner, allowing Bell to file an interference suit against the yet-to-be issued Edison patent. This tactic permitted Bell to use a carbon transmitter, like Edison’s, without being immediately stopped by the courts. Fortune then prevailed, when in December, they acquired the patent rights to a transmitter invented by Francis Black Jr. – an improvement over Edison’s.297 By the end of 1878, Bell had a competitive, even better, telephone.

WU-AST reacted as would be expected – by accelerating its efforts to force the Bell local agents out of business, or to buy them. Vail needed to provide financial assistance to the local agents who were confronted with all the costs and risks of becoming switch operators. For those willing to sign new contracts, Vail was prepared to advance them financial help – such as reducing or deferring telephone instrument lease payments – in return for becoming a shareholder. Vail’s efforts proved successful. BTC could not produce instruments fast enough. Where they could not supply enough telephones, WU-AST used its scale advantages of production and grew even faster.298

These competitive dynamics strained the weak financial conditions of both NETC and BTC. To survive and execute their grand system meant raising more money, which meant conceding even more authority to investors. They had little choice. Speaking with one voice, with pooled and new resources, seemed wiser than trying to coordinate policies and resources between two weakening firms. On March 20, 1879, the two companies were combined into the National Bell Telephone Company (NBTC). Capitalization was $850,000, with $430,000 of new cash.299 Hubbard stepped down, and left the company, unwilling to play a lesser role.300 William H. Forbes became the new president.301 Vail continued as general manager. While Graham still carried the title of electrician, Watson general inspector, and Sanders, Director, the influence of the four founders was effectively finished. Investors – Bostonians – had assumed financial control.

Both NBTC and WU were weakened by their struggle, a situation too tempting for the most notorious financial Robber Baron of the day, Jay Gould, to resist. Gould and WU first tangled in 1870 when he bought the Atlantic and Pacific Telegraph Company (APT), from the Union Pacific Railroad.302 Gould built the APT into, if not a formidable, then a pesky competitor to WU. (Gould used to expert advantage the Sherman Act of 1866.303 )WU finally bought Gould out in 1877, but refused to give him a board seat. Seeing WU now susceptible to another take-over, in April 1878, Gould began buying into a number of NBTC licensees, a situation that worried the principal NBTC shareholders enough to cause them to sign an agreement forcing purchase of all of their stock to purchase any.304

In May, Gould capitalized American Union Telegraph Company (AU) with $10 million. Into it he put telegraph systems and railroad right-of-ways he controlled. WU may not have feared NBTC, but Gould was different, particularly if he was successful in combining his telephone and telegraph interests. WU management, having by then received counseled from some of the best legal minds in the country that the Bell patents would prevail, decided to negotiate a settlement with NBTC, hoping to strengthen NBTC to Gould’s advances, and leave WU to focus on telegraphy and once again fend off Gould.

WU began the negotiations willing to settle in favor of NBTC, that is if NBTC ceded WU control of long distance communications. While some NBTC shareholders were willing, Vail refused to abandon his strategy and WU’s proposal was rejected.305 Without a basis for agreement, yet both sides wanting to negotiate a settlement, each company created a three man team to negotiate. They also agreed not to launch new exchanges. But with each passing month, competition within existing exchanges became ever more brutal, with WU-AST giving telephones away, presumably to force NBTC to capitulate.306 Then on November 10, 1879, after an all-night negotiating session, Vail forced an agreement for the remaining period of the patents, seventeen years.307 (Vail won by threatening to enter the telegraph business.) WU agreed to: admit that Graham invented the telephone, exit the telephone business, and grant NBTC a license to all the telephone patents it had acquired or would acquire during the term of the agreement. NBTC agreed to: acquire all WU-AST telephones, of which there were over 56,000 in fifty-five cities, as well as fifty-five telephone exchanges;308 stay out of the telegraph business; and pay WU 20% of the royalties, or rentals, from telephone instruments.309 (Bell would end up paying WU $7 million.310 In 1881, Gould will sell AU to WU and, in the process, become the controlling member of WU’s board of directors.311 The intrigue between WU and Bell will be continued.)

With the announcement of the settlement in 1879, NBTC’s stock price soared to $1,000 per share, an increase of 2,000% from the March price of $50 per share.312 The original four founders became millionaires. Vail became a millionaire by selling shares of his stock in BTC-NY to NBTC to give them control of BTC-NY.313

The settlement between NBTC and WU had profound historical consequences. In order to uphold its terms of the settlement, as well as perform as the surviving monopoly, NBTC took actions and adopted attitudes that persisted for nearly one hundred years – until the convergence of telecommunications and computers. The effects on NBTC can be summarized into four themes: the need for more money, the legal battles over patent rights, the need to rationalize product supply, and the institutionalization of innovation.

To buy WU’s installed base of 56,000 telephones and fifty-five exchanges with switching equipment meant raising millions of dollars, something NBTC could not do under its existing Massachusetts incorporation agreement. Furthermore, it needed broadened rights to do business in other states and own stock in licensees as well as other telephone-related companies – like manufacturers. To effect such changes in their incorporation charter meant securing approval of the Massachusetts legislature. Counsel warned management that winning these changes would not be easy, for no longer would they be viewed as a sympathetic, struggling upstart, but another to-be-feared monopoly. Counsel’s advise proved correct, once the changes were requested, political opposition emerged. The first bill to be reported out of the Senate Committee on Mercantile Affairs granted only half the increase in capitalization, restricted the new money from being used to purchase patents, and subjected telephone rates to regulation by the state’s Board of Railroad Commissions.314 After more negotiations and hearings, the legislature approved the American Bell Telephone Company charter on April 2, 1880. Capitalization was $10 million, not the $15 million requested, and ownership of Massachusetts licensees could not exceed 30% – elsewhere there were no constraints. The call for rate regulation had been dropped. On April 17, 1880, NBTC became the American Bell Telephone Company (ABTC) – initial capitalization: $7.35 million.315

Another consequence of the negotiated settlement with WU was that it left unanswered the question: How would the court’s rule on the validity of Graham’s patents? This uncertainty encouraged others who thought they had legitimate patent rights, and many others who had no qualms fabricating such rights, to enter the telephone business. Contributing to the surge in competition was the anti-Big Business attitude of the early 1880’s – as exemplified by the state Quo Warranto suits. This political climate bolstered the resolve of all those who saw an opportunity to make money from the telephone simply by entering the business, regardless of the rights of ABTC.316 If denied their economic freedom to compete by the court, they had confidence they would win it back by legislative action. From 1880 to 1893, ABTC filed six hundred patent infringement lawsuits, with five collections of cases – Amos E. Dolbear et al., Molecular Telephone Company et al., Clay Commercial Telephone Company et al., People’s Telephone Company et al., Overland Telephone Company et al. – all appealed to the Supreme Court.

The fight over ABTC’s patent rights was not limited to the courts. One such case was that of the Pan Electric Telephone Company (PETC). Founded in 1883 around the patents of J. Harris Rogers, PETC had two U. S. Senators as directors. In November 1884, ABTC filed suit against PETC. Those supporting PETC then attempted to pass legislation in Congress authorizing the Government to file suit and vacate patents under certain circumstances – such as those of ABTC.317 The measure passed the House, but not the Senate Committee on Patents.

Soon afterwards, PETC’s attorney became Attorney General of the United States. When requested to file suit against Graham’s patents, to have them declared fraudulent and invalid since Graham was not first to have invented the telephone, the Attorney General declined to do so – presumably because of clear conflict of interest. But when he left Washington for a few days, another conveniently timed request was made, and on one day’s examination, the Justice Department filed suit against ABTC.

The Circuit Court hearing The American Bell Telephone Company et al. v. The Pan Electric Company et al. then ruled for ABTC.318 PETC’s lawyer argued that any decision should be stayed until the government’s case against ABTC was decided. If the Court agreed, PETC could continue doing business. However, in the rush to file suit, the Justice Department had committed an oversight, and the case had to be temporarily withdrawn. President Forbes of ABTC then met President Grover Cleveland to argue ABTC’s case. (See Appendix 2.4 Excerpts of President Hudson’s Request.) Without the pending case against ABTC, the Circuit Court rejected PETC’s request for a stay: PETC did not appeal. On January 1, 1887, the Government filed United States v The American Bell Telephone Company and Alexander Graham Bell. Over a year later, March 19, 1888, the Supreme Court ruled by a vote of four-to-three in favor of ABTC in all five cases before it. Nine years later, in 1896, two years after Graham’s patents had expired, the government abandoned its case.319

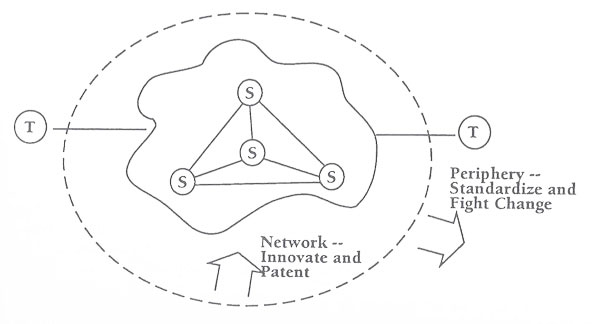

A third consequence to ABTC of its settlement with WU in 1879 was the need to rationalize its product supply. ABTC needed a more reliable and larger supply of product than their string of small production shops centered around Charles William. In February 1880, ABTC had 60, 873 telephones with licensees and 138 exchanges and was about to take-over the 56,000 telephones and fifty-five exchanges of WU. All of these telephones had to be upgraded to instruments with both a transmitter and a receiver, meanwhile satisfying the growing demand for new telephones. These unprecedented demands on production capacity needed an immediate solution. Two decisions were made: buy control of Western Electric Manufacturing Company (WE) and standardize the telephone. WE was the largest electrical manufacturer in the country, and WU’s telephone supplier. As part of the settlement agreement between ABTC and WU, WU severed its formal relationship with WE. In July 1881, ABTC bought 40% of WE.320 In February 1882, ABTC increased their controlling ownership to 52.05%.321 Then ABTC and WE signed agreements under which ABTC agreed to buy only from WE, and WE agreed to sell only to ABTC.322 (This agreement becomes a century long focus of government investigation and legal action.) The second decision was to standardize. Standardization was needed if there was to be high volume, high quality, low cost production. Standardization both simplified switch design and implementation, in essence creating a barrier, a firewall, against competitor’s efforts to penetrate transmission and switch technologies. The telephone was simple – so they standardized. Transmission and switching requirements were complex and difficult – so they invested in innovation with the objective to create protective patents.

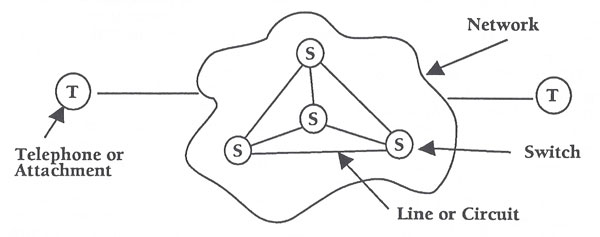

A fourth consequence of the 1879 settlement was the institutionalization of innovation. Having established its monopoly, Vail next needed to materialize the grand system before Graham’s patents expired. To do so meant growing the local exchanges into competitively viable operations and then interconnecting them with long distance calling. But Bell did not have the mastery of the technologies needed to execute Vail’s vision. Vail had two strategies: acquire every patent possible and begin internal development of needed technologies. By 1894, Bell acquired over nine hundred telephone patents323 – Vail would call them”a thousand and one little patents and inventions.”324 (Undoubtedly some patent acquisitions were in lieu of patent lawsuits.) In 1881, in addition to investing in WE, obtaining their technologies and patents, ABTC created an Electrical and Patent Department325 to conduct development of transmission and switching systems as well as evaluate outside inventions.326 A telecommunications system became, therefore, instruments connected to a network consisting of transmission and switching. (See Exhibit 2.10 A Telecommunications System)

Exhibit 2.10 A Telecommunications System

While WE and WU patents enhanced Bell’s switching competence,327 two transmission problems remained unsolved: underground cabling and long distance transmission. In the larger exchanges, such as New York City, the ugly tangle of overhead wiring had become both impossible to keep operational, and a source of public protest. By 1884, public demand to âPut the wires underground caused the New York Legislature to pass a law requiring underground cabling and created a commission to assure the law’s compliance328 . In 1885, ABTC filed such a plan,329 and by year-end nearly 750 miles of underground cabling had been installed. (By 1889, New York City had eleven thousand miles of underground cabling.330 )Long distance transmission proved even more intractable. In 1880, when the longest working line was twenty-eight miles,331 work began on a circuit connecting New York City and Boston. Early frustrations in achieving acceptable transmission quality prompted John J. Carty, a project engineer, to try using a complete metal circuit instead of a single wire with ground return. The performance improved profoundly, ushering in long distance telephony. In 1883, Bell created a laboratory to do research in long distance telephony.332 And in the Spring of 1884, long distance service was established between Boston and New York City.333 It would take until 1892 to establish service to Chicago, immediately prior to the patents expiring, and 1914 to connect to San Francisco. The success in solving the problems of underground cabling and long distance transmission confirmed the value of internally directed innovation – not simply relying on others to innovate. As the telephone system became ever more complicated, outside innovation became less and less likely to be of help. Even so, laboratory innovation remained focused on incremental improvement, not achieving radical technological progress.334

Vail at last had technology capable of turning his vision into reality. A next logical extension of the network was to link New York and Philadelphia. To raise the money needed, ABTC sought permission from the Massachusetts Legislature to increase its capital from $10 million to $30 million, and to issue the stock at par. Their request was turned down because construction and operation of long distance telephone lines caused ABTC to be classified as a public service corporation, and public service corporations could not issue stock at par when the market price exceeded par, as it did in ABTC’s case.335 Not to be denied, ABTC incorporated the American Telephone & Telegraph Company (AT&T) in New York to take advantage of the more favorable incorporation laws. (See Appendix 2.5 The AT&T Charter. This charter shows the erosion of States’ control over corporations.) Vail, in an effort to reduce his workload, resigned as general manager of ABTC and became President of AT&T. Even so, his strategy remained in place and ABTC continued to add local exchanges as they had once created BTC-NY, by finding local investors yet keeping 30 to 50% of the stock for license rights to ABTC’s patents, technical assistance and exclusive equipment contracts.336 ABTC also began offering licensees permanent contracts in lieu of their traditional five year contracts if the licensees gave ABTC stock ranging from 30 to 50% – usually 35%.337 These new permanent license contracts limited the financing options of the licensees; such as not being able to borrow money without the permission of the licenser, and having to issue new capital stock, not invest profits, for the funds to expand the business.

These four attendant consequences of the 1879 settlement – increased need for capital, yet the threat of regulation; elimination of WU as competitor, but protracted patent fights in the courts, legislatures, and executive suites; standardization of the telephone, as well as acquisition of WE and subsequent stranglehold on product being used in the telephone system; and, the institutionalization and success of innovation – all set in place the assets and competencies needed to realize Vail’s strategic vision. But they also gave rise to a besieged mentality that caused Bell to want to insulate itself from competition and outside interference. They did so by standardizing at the periphery of the network – at the time only the telephone – and building a network so advanced and protected, not only with patents but an organization dedicated to innovation, that no one would ever want to take them on. (See Exhibit 2.11 Bell’s Telecommunications System Strategy.) This emergent attitude and collective purpose became so embedded that it took nearly a century for it to be successfully challenged and forced to change – and now the focus of this reconstruction.

Vail’s unswerving drive to create a national system brought him into increasing conflict with the Boston investors controlling the company. Building a national network cost money, lots of money. However, the controlling investors were more interested in distributing dividends than re-investing profits into network expansion. For example, in 1882, ABTC distributed $600,000 in dividends when profits totalled only $1 million. In total, by 1894, when the two basic patents expired, $25 million in dividends had been paid out, for roughly a 46% average return on investment.338 In addition to the dividend return on capital invested, the value of early owners’ stock increased ten times their costs.339 The differences between Vail and the investors came to a head in 1887, when Vail was not named company president. He resigned and left the telephone business to pursue personal investments. (He will return.)

Exhibit 2.11 Bell’s Telecommunications System Strategy

Era of Competition 1894-1906

In November 1891, the U. S. Patent Office, after a fourteen year investigation of prior art, finally issued to ABTC, as assignee of Berliner, a patent for his telephone transmitter – surprisingly still the best available. To Bell’s management, the delay must have seemed like a gift. For now they could extend their monopoly of the telephone to 1908 – the seventeen years of patent protection – giving them more time to build network superiority. James Storrow, Bell’s lawyer, wrote President Hudson: “The Bell Company has had a monopoly more profitable and more controlling – and more generally hated – than any ever given by any patent. The attempt to prolong it…by the Berliner patent will bring a great strain on that patent and a great pressure on the courts.”340 He couldn’t have been more prescient.

Bell was easy to hate in a time when it was popular to hate Big Businesses. Bell’s unpopularity stemmed from the obscenely high prices they were thought to be charging, the marginal service they provided, and their unwillingness to expand telephone service to meet demand. As proof of high prices, people pointed to the egregious dividends being paid. Poor service needed no proof, for everyone agreed it often bordered on barely working.341 And as for not extending service to the sparsely populated Western states, or to rural farm communities, Bell management believed that if expanded telephone service was not profitable from the start, then why incur the expenses. This almost customer be damned attitude reflected a corporate culture that treated the telephone as Bell’s to do with as pleased, including the right to earn a monopolist’s capital return.342 And as for not asserting the Berliner patent rights, fighting change at the periphery of their network was core to Bell’s competitive strategy. So even though they were warned not to enforce the Berliner patent, management saw a way to extend their control over the telephone and were determined to make the most of it; in a sense, who could blame them given their unblemished litigation record.

In 1893, the Attorney General of the United States filed suit in Massachusetts to have Berliner’s patent annulled on the grounds that it was wrongfully delayed by the Patent Office, with ABTC’s complicity. In 1894, the Federal Court of Massachusetts ruled the patent null and void. On appeal, the Circuit Court of Appeals reversed the judgment, and, in 1897, the Supreme Court sustained the patent.343 Then, in 1903, in a patent infringement suit against the National Telephone Company, the Berliner patent was construed so narrowly as to end its effectiveness. The courts’ attitude towards Bell shifted in 1897 when the Court began ruling very narrowly in many of the seventy-four patent infringement suits Bell filed, a change very much induced by an unwillingness of the courts to be perceived as favoring a monopolist.344

Bell’s efforts to suppress competition by enforcing the Berliner patent had little effect on all those who had hungered for years to be free of Bell’s monopoly. Beginning in 1894, competitors emerged and, by 1900, over five hundred new telephone companies were forming a year.345 (See Exhibit 2.12 New Telephone Companies by Year.) Competition made it possible for those without telephone service, as well as those with only visions of making money by entering the telephone business, to install their own telephones. AT&T had correctly anticipated that competition would emerge after their two key patents expired – that many thousands of new telephone companies would form surely came as an unwelcome surprise.

Exhibit 2.12 New Telephone Companies by Year

| YEAR | Commercial Systems | Mutual Systems |

|---|---|---|

| 1881 | - | 2 |

| 1883 | 1 | 1 |

| 1884 | 2 | - |

| 1885 | 4 | - |

| 1886 | 5 | - |

| 1887 | 3 | - |

| 1888 | 8 | 1 |

| 1889 | 6 | - |

| 1890 | 7 | - |

| 1891 | 8 | 2 |

| 1892 | 12 | - |

| 1893 | 18 | 9 |

| 1894* | 80 | 7 |

| 1895 | 199 | 15 |

| 1896 | 217 | 21 |

| 1897 | 254 | 32 |

| 1898 | 334 | 75 |

| 1899 | 380 | 84 |

| 1900 | 508 | 181 |

| 1901 | 549 | 269 |

| 1902 | 528 | 295 |

| Total | 3123 | 994 |

*AT&T Patents Expire

(Note: Commercial systems include all for-profit companies competing with the Bell System, whereas mutual systems were cooperatives in which profit was a secondary concern to telephone service itself.)

ABTC’s competitive strategy required coordinated collective behavior delivering utility to users as one telephone with universal connectivity. Coordinated collective behavior meant licensees acting like one organization – local competition might be unavoidable, but regional, or, even worse, national, competition had to be resisted in every way possible. Since ABTC was the major shareholder of only a few licensees, gaining collective agreement would not be easy. For those licensees facing competition, and about half did (See Exhibit 2.13 Telephone Competition - 1898.), ABTC wanted the licensees to respond aggressively, even if it meant losing money.346 (ABTC favored aggressive competition over acquisition of competitors because of the threat of antitrust, or regulatory, actions by Federal or State governments. An acquisition strategy might also have the unintended effect of encouraging more competition. Weakening competitors held the possibility that if acquisitions eventually became necessary, the prices paid would be lower.) If pursuing aggressive tactics meant licensees needed financial help, ABTC stood ready with capital to invest which had the effect of making ABTC an ever larger shareholder, and, therefore, increasingly able to dictate licensees’ behavior. Competition, therefore, had the effect of consolidating the Bell interests. (Between 1885 and 1889, ABTC increased its ownership in seven key licensees from 13% to 52%.347 )

Instructing licensees to compete aggressively also required ABTC to grant financial assistance by reducing the telephone rental rates it was charging. From 1885 to 1893, telephone rental rates received by ABTC from the licensees had ranged from $5.38 to $5.84 per month.348 In 1894, the average rate dropped to $3.89, in 1895, $2.18, and by 1898, $1.45. ABTC rental income peaked in 1893 at $3,256,000, and, even with unprecedented growth in telephones, telephone rental income dropped to $1,611,000 by 1898. ABTC’s total income from the licensees – both telephone rentals and dividends – remained essentially flat, however, dividend income increased from $1,824,000 in 1893 to $3,239,000 in 1898. Dividend income increased as ABTC became an ever larger shareholder in licensees.

Exhibit 2.13 Telephone Competition - 1898

| Region | Number | % | % | % | % |

|---|---|---|---|---|---|

| Urban centers with population greater than 4000 | 1157 | 100 | |||

| With a telephone company | 1002 | 87 | 100 | ||

| With Bell Telephone Co. only | 414 | 41 | |||

| With direct competition | 451 | 45 | |||

| With Independent Only | 137 | 14 | |||

| Urban Independent - no competition | 137 | 4 | |||

| Urban Independent - full competition | 451 | 14 | |||

| Other Independent | 2535 | 82 | |||

| Total Independent | 3123 | 100 | |||

| Total Bell Companies | 865 | 22 | |||

| Total Independent | 3123 | 78 | |||

| Total Telephone Companies | 3988 | 100 |

Note: Each percent column represents a different analysis.

Price competition also required a change in the historical practice of billing telephone service as an annual fixed price with no constraints on use. The issue of how to best price telephone service had been debated ever since the first meeting of licensees as the National Telephone Exchange Association in 1880.349 Most licensees felt they were losing money with the simple flat charge and sought a new system of less expensive pricing for infrequent use and continuous pricing for extensive use. Now that competition was forcing lower prices, and experience had suggested users would pay more for a system with high connectivity, message unit pricing350 became a way to price to market need. (The underlying problem being that switching suffered diseconomies of scale. New York City was converted to message unit pricing in June 1894.)

The combination of needing more capital to invest in licensees as well as its long distance services, and experiencing flat income, made raising capital not only necessary, but significantly more difficult and compromising. Wisely, ABTC had anticipated the need for capital before competition began. In 1889, it received approval from the Massachusetts Legislature to increase its authorized capital to $20 million. In 1894, ABTC sought another increase, to $50 million, which was approved by the legislature but vetoed by the governor. The governor believed the increase unnecessary, and, because in his mind ABTC was a public service corporation, it had to obey the public service laws and restrictions, including no stock-watering – such as raising unnecessary capital. Feeling stressed to raise money, President Hudson acquiesced, and a bill was passed recognizing ABTC as a public service corporation and increasing its authorized capital to $50 million. When more capital was needed in 1899, ABTC and its New York subsidiary consolidated with AT&T becoming the new parent holding company351 – the laws of New York were more beneficial and did not require AT&T to be classified as a public service corporation. Thus in 1899, the historical parade of Bell companies finally ended. AT&T held all the stock of the licensees, including ABTC. The newly authorized capital of AT&T was $100 million – twice the capitalization of ABTC.

In October 1899, President Hudson suddenly and unexpectedly died.352 The Board of Directors tried to convince Vail to return, but he declined saying he had too many other obligations. Frederick P. Fish, a patent lawyer and director of AT&T, was elected the new President. Fish believed AT&T had to meet the competition by growing, and by changing Bell’s disreputable image to one dedicated to public service – the customer had to be treated as important, not as lucky to have whatever service they were getting. In 1903, he wrote: We must give good service and must do everything that is necessary to have good service. Most of our opposition troubles are due, not so much to rates as to two other things, namely, bad service and not covering the field.353

President Fish also believed in squashing every effort by competitors to organize long distance services. The independents knew they had to offer long distance services if they were to be successful, and a number of efforts to establish such services were attempted. The most serious effort began in November 1899 with the incorporation in New Jersey of the Telephone, Telegraph and Cable Company of America (TTCCA); authorized capitalization: $30 million. Financed in part by the Rockefellers, TTCCA planned to become a totally integrated telephone company and immediately began investing in local exchange companies. Soon thereafter, some of the key backers of TTCCA withdrew their support, allegedly persuaded by J. P. Morgan, who was owed favors by those involved.354 Morgan’s interest sprang from a desire to consolidate the communications industry as he had the railroads, and do for steel and other industries. In 1902, AT&T sold 50,000 shares of stock to a small group of investors, including Morgan, and then added three new members its Board of Directors355 – two bankers and Vail.

The new board members bolstered Hudson’s resolve to change AT&T’s culture to compete aggressively. In 1902, three actions taken had lasting impact: a change in the basic terms of the Bell licensing agreement, the introduction of AT&T’s first PBX, and a more accommodating policy towards competitors. The steady erosion of telephone rentals to AT&T, and the odds against the trend ever reversing, motivated AT&T to replace its license fee of rentals or royalties on telephones with a 4.5% fee on licensees gross revenues. Fish sold the change on the basis that it would: involve a substantial reduction in the amounts paid to AT&T.356 The asset value of telephones, however, would remain on the books of AT&T. This change would become a source of bitter contention with emerging state regulatory authorities.357 For instance: What was the justification for 4.5%? AT&T responded by stonewalling the regulators, taking the view that the value received was greater than the fee paid and that was all that mattered; specifically, AT&T’s cost to deliver such services was irrelevant. It took decades and three Supreme Court decisions to resolve the controversies of this new agreement.358

When Bell changed its pricing to one based on message units, the benefits of this reduced entry level pricing to match competition as well as continuous pricing to discourage unnecessary telephone use, but it also created serious problems with AT&T’s most treasured customers – businesses.359 Businesses, the most intense users of telephones, saw their costs increase at a time when most were aggregating into larger organizations that demanded more internal communications to coordinate increasingly complex operations. A solution to this need for cheap, unlimited intraorganizational communications had first appeared in 1879 – the private branch exchange, or PBX.360 A PBX was an on-premises exchange, or switch, that enabled a large number of internal telephones to connect to each other without involving AT&T, or other common-carrier, switches or lines. At the same time, the PBX had a smaller number of trunks, or lines, that were connected to the common-carrier network. When an internal telephone needed to be connected to an outside line, it could, and would incur common-carrier charges. All internally connected calls, however, would not incur costs other than those attendant to the PBX itself – before the PBX all calls had to involve common-carrier lines and charges.361 By 1897 there were 150 PBX’s in New York City, none of which were AT&T’s. Not until 1902 did AT&T introduce its first PBX, known as the No. 1 PBX.362 Limited to two sizes: 30 or 80 maximum subscriber (internal) lines. It was succeeded by the No. 2 PBX in 1903, and newer models almost every year. (By 1929, 130,000 PBX’s were in operation.363 ) The PBX facilitated, even made possible, the consolidations into large organizations of the 1898-1907 period. (Their use helps explain the drastic drop in common-carrier connections in 1903. (See Exhibit 2.8 Growth Rate in Calls Per Day))

The third important change of 1902 involved AT&T’s attitude towards competitors. First, AT&T adopted a more lenient policy toward independents allowing those independents operating where Bell had no intent of initiating service to connect to their system. All equipment, however, had to be WE supplied. Even so, this more accommodative policy had immediate impact. At the end of 1901, less than 50,000 independent telephones connected to the Bell system. In 1902, the number nearly doubled to 84,000, and would increase substantially every year after.364 A second change in AT&T’s attitude towards the Independents was a willingness to make acquisitions.365 These changes, while meaningful, did little to ameliorate the hostility felt by most independents who increasingly sought political solutions to what they could not achieve through market competition.

As committed as AT&T became to staving off competition, by 1907 the Independents had installed almost as many telephones as had Bell – 2,987,000 Independent telephones versus 3,132,00 for Bell.366 The declining fortunes of AT&T combined with its more aggressive growth posture necessitated raising ever larger amounts of capital.

In February 1906, AT&T sold $150 million of convertible bonds to a syndicate of New York investment banks led by J. P. Morgan.367 Days after the sale, the terms of the bonds were changed so that the bankers maintained full control over bond rights until the syndicate dissolved, in roughly two years. When only $20 million of the bonds could be sold, reflecting growing disillusionment with AT&T’s financial performance and negative public image, the bankers asserted their new powers and demanded a reorganization committee to review what could and should be done to turn the situation around. The committee, Vail a member, proceeded to study the contemporary changes to many of the large industrial corporations – the result of 1898-1906. Although Fish was re-elected President at the March Shareholder meeting, the investment bankers continued to press for change, and on May 1, 1907, Fish resigned. The Board of Directors then persuaded Vail to return as President.

Vail Rejoins AT&T 1907-1919

The sixty-two-year-old Vail brought vision and leadership to an AT&T badly in need of both. Gone were the joys of building the grand system; replaced with the drudgery of competing and the stresses that predictably followed. The day-to-day details had sunk the lofty ideals for the great Yankee invention into the unrecognizable, and Vail was just the man needed to reinvigorate an organization that had passed him over two decades earlier. For Vail, having since earned millions investing in international ventures, as well as recently suffering the tragic deaths of both his wife and daughter, the time was at hand to do great deeds and to leave his mark. He was prepared and ready, and had as his friend and visionary banker, the great consolidator of American industry, J. P. Morgan. Together they would transform a weakening AT&T into telecommunication’s monopoly.

Vail’s passion to create a national telephone system with AT&T in control may have been born in economic logic, but it was fueled by his sense of what was morally right. To achieve his objective he needed to strengthen AT&T, eliminate competition, leverage technology and ward off potential government interference. He knew what he wanted and had to do and wasted no time getting started.

Strengthening AT&T meant first of all raising badly needed cash. The six-month moratorium of capital investment had wreaked havoc with not only essential telephone construction, but with the perception of AT&T’s corporate viability. (Corporate debt had zoomed to $202 million in 1907, three times that of 1902.368 ) Unless AT&T could reliably provide the capital needed by the licensees, as well as fund the development of its long distance network, there was no prediction of what might happen. So even though AT&T stock now sold for $115 a share, having traded as high as $186 in 1902, Vail offered to sell existing shareholders one share for $100 for every six shares they owned. Despite depressed market conditions and the strong reservations of AT&T’s financial advisors, the May financing proved successful and AT&T raised $20 million.369

With the cash problem temporarily solved, Vail next tackled the more difficult problem of company morale and confidence. He traveled, he talked, he listened, and he demonstrated that even his legendary reputation was no match for the Vail that now swept away their doubts and had them all believing in the importance of the telephone, the mission of AT&T, and his ability to lead them to success. That summer he invited Bell personnel from around the country to sail the Hudson River and Long Island Sound aboard the yacht Mohican, where he graciously played host and began building the personal relationships that transformed work into cause. Vail led as only a man of vision and character could, and the people of AT&T responded.

A vision as large as the one bequeathed by Graham and operationalized by Vail left little room for the divisive competition that had overtaken the telephone business. Vail wasted no time making it known that AT&T had changed its ways. In August, he changed long standing policy so independents could buy equipment from WE, whether they connected to the Bell system or not. When the October 1907 stock market crash pushed many independents to the brink of disaster, Vail began acquiring them rather than trying to force them into bankruptcy.370 The new AT&T wanted to lead, not bully.

Vail, who believed in the unlimited possibilities of technology, must have been shocked to learn how little AT&T had innovated for all the money it had spent. Under written directions from Morgan to cut costs: We consider it of vital consequence to the financial welfare of the Company that no expenditures should be entered upon in the near future, except such as are absolutely necessary, no matter what the prospective profits on other expenditures may be,371 Vail complied, firing 12,000 employees. He also reorganized and centralized research and development. First, he replaced Hammond V. Hayes as head of engineering372 with his old friend, and innovator of the two-wire circuit, John J. Carty. Carty immediately reduced both staff and expenses, and then transferred the technical staff from Boston and Chicago to New York; where some joined the staff at AT&T headquarters and the balance worked at WE.373 Carty, unlike Hayes, believed in fundamental research and the importance of technology to progress: I believe it will be found in any social organism that the degree of development reached by its telephone system will be an important indication of the progress which it has made in attaining coordination and solidarity.374 Carty’s promotion marks the true beginnings of scientific research and its institutionalization within AT&T; those transferred to WE will form the basis of the future Bell Laboratories. No longer would each of the local telephone companies innovate, innovation would be centralized.375 Carty also stressed the importance of standardization376 – going so far as to ban further use of the French handset telephone which had the receiver and transmitter in a single handle; not until 1927 would AT&T reintroduce a single-handed model.377

At first the style of innovation under Carty remained incremental.378 Then in late 1908-early 1909, Vail set the goal of transcontinental telephone service by the time of the upcoming San Francisco Panama-Pacific Exposition scheduled for 1914; impossible to even contemplate without a broad-based, organized engineering effort.379 By 1910, AT&T’s research laboratories were beginning to stress new, radical innovation.380 And by 1912, Vail could pronounce that AT&T was capable of continuing to grow indefinitely not only in size but in constantly increasing efficiency and usefulness.381 (Acquisition of the patents of outside inventors will continue to be important however – the audion tubeof Lee De Forest (1913) being such an example.382 )

All of Vail’s efforts to create a dominant AT&T were threatened, however, by growing public sentiment that the telephone business, and especially AT&T, should be regulated, broken-up, or worse yet, taken over by the government. The signs were everywhere and hard to ignore.383 Vail, totally dedicated to building a unified, national telephone system, quickly became the pragmatist, preferring to accept government oversight on grounds acceptable to AT&T rather than risk losing the fight and having terms dictated by politicians. In AT&T’s 1907 Annual Report, Vail wrote, as if negotiating:

It is not believed that there is any objection to [public control] provided it is independent, intelligent, considerate, thorough and just, recognizing, as does the Interstate Commerce Commission…that capital is entitled to fair return and good management or enterprise to its reward.384

Being innovated was a privately-owned and managed, publicly-regulated, national telecommunications monopoly.

The states were asserting their roles as well by legislating public utility commissions. At this same time, AT&T was wrestling once again with the question: How should it be organized? Since state boundaries had been but one consideration used in granting licensee contracts, AT&T now represented a hodgepodge of geographically-based licensees which needed to be coordinated into collective behavior. (The various States also had different institutions, such as corporate or commercial law, that incented, or disincented, economic behavior.) In 1907, eight states had passed laws regulating telecommunications – the telephone and telegraph systems. By year-end 1911, fourteen more states vested authority with public-utility commissions to regulate telecommunications. Throughout these years, AT&T tried various strategies of incorporating state boundaries into AT&T organizational units, both compatible and, to thwart regulation, incompatible.

In 1909, AT&T acted to consolidate all the licensees of the state of New York into one legal organization – the New York Telephone Company (NYTC). Simultaneous with the reorganization, AT&T decided NYTC needed to raise money; however, WU which owned a third of NYTC could not fund its pro rata share and sold its ownership to AT&T.385 A few months later, AT&T bought a controlling interest in WU from George J. Gould, son of Jay the Robber Baron, and his associates. In 1910, Vail was elected President of WU, while remaining President of AT&T – the company that had given him his first full-time job. Vail strongly believed in the synergies between the telephone and telegraph, and quite contrary to what outsiders presumed, Vail began investing both management and capital into WU.

Not that AT&T always played fair, for they didn’t. Raising havoc with the efforts of the independents, and long distance competition to gain access to capital, and thus the funds needed to grow, was a typical ploy. Morgan and other friendly investment and commercial bankers were silently buying up independents in the Midwest with the intent to sell them to AT&T.386 AT&T acted aggressively, and the competitors didn’t like it.

In 1910, Congress reacted to the clamor for government legislation and held hearings on whether to regulate the telephone. The authority of Congress and the Federal Government came from the 1877 Supreme Court decision, Pensacola Telegraph Co. v. Western Union, which ruled telegraph communications, and by extension the telephone, between states was interstate commerce. Vail, now prepared to accept, even want, regulation if it meant no new competition, he testified:

Now the telegraph line and the telephone line are becoming rapidly as much a part of the instruments of commerce and as much a necessity in commercial life as the railroads.387

In June, Congress passed the Mann-Elkins Act which gave the ICC (Interstate Commerce Commission) authority to regulate telephone communication rates, undertake property valuations, and prescribe uniform accounts and financial reports.388 However, legislation was a long ways from any, let alone effective, regulation. Hence, negotiations continued. Vail in the Annual Report of 1910 wrote:

The Bellsystem was founded on broad lines of One System, One Policy, Universal Service, on the idea that no aggregation of isolated independent systems not under common control, however well built or equipped, could give the country the service. One system with a common policy, common purposes and common action; comprehensive, universal, interdependent, intercommunicating like the highway system of the country, extending from every door to every other door, affording electrical communication of every kind, from every one at every place to every one at every other place.389

Vail also wrote he wanted Bell to be operated as an end-to-end service with no foreign attachments, i.e. other manufacturer telephones.390

The Department of Justice, no doubt emboldened by the Standard Oil and American Tobacco Supreme Court decisions of 1911, began an investigation of AT&T to determine if it should file an antitrust suit. On January 7, 1913, Attorney-General Wickersham addressed a letter to Charles A. Prouty, Chairman of the ICC, requesting an investigation of the rates and practices of the telephone companies.391 The ICC agreed. But by July 1913, AT&T’s aggressive behavior of consolidating and acquiring, or otherwise eliminating, competition had become too much. (Between 1907 and 1912, the market share of independents fell from 48.8 percent to 41.7 percent nationally, while the percentage of non-Bell firms connected to the AT&T network increased dramatically from 26.6 percent to 63.5 percent.392 ) When AT&T acted to buy a long distance company in Oregon, the Justice Department under the newly elected Woodrow Wilson, filed an antitrust suit in the Federal District Court of Oregon. In November, Postmaster General Albert S. Burleson published a report advocating government ownership of the national telephone system, with a long excerpt read into the Congressional Record in December.393

Then on December 19, 1913, Nathan C. Kingsbury, an AT&T first vice president, wrote a defining letter to Attorney General James C. McReynolds. (See Appendix 2.6 Kingsbury Letter.) In sharp contravention to then current policy, AT&T agreed to cease buying competitive telephone companies without prior Department of Justice approval and to provide standard trunk lines to Independent exchanges; where standard assumed the Bell telephone. It also agreed to sell its ownership in Western Union.394 Thus, an out-of-court agreement with the Justice Department had been reached, settling the antitrust suit. President Wilson expressed pleasure that AT&T: should thus volunteer to adjust its business to the conditions of competition.395

AT&T had effectively accepted regulation, and the Government had sanctioned the then existing AT&T as not in violation of the Sherman Act. Institution working – antitrust - and institution changing -what antitust meant for and with AT&T. And so came to a close Bell’s second era of competition. Now, AT&T and the independents were to work together to bring about a national telephone system. However, AT&T was not to be denied so easily – Vail had embedded the logic, and imperative, of one grand system too deeply into the culture and people of AT&T.

- [283]:

Paine, pp. 105-109

- [284]:

Albert Bigelow Paine, “In One Man’s Life: Being Chapters from the Personal and Business Career of Theodore N. Vail,” Harper & Brothers, 1921, p. 107

- [285]:

Brooks, p. 67

- [286]:

Paine, p. 14 and Oslin, p. 223

- [287]:

Paine, p. 17

- [288]:

Brooks, p. 68

- [289]:

Paine, p. 36

- [290]:

Ibid., p. 114

- [291]:

Brooks, p. 69

- [292]:

Paine, p. 125

- [293]:

E73

- [294]:

The Bell Telephone Company of New York sold 1,050 shares at $2.50 each. Vail bought 150. Edwin Holmes bought 300 as did Thomas J. Brady, Second Assistant Postmaster General.

- [295]:

The Bell Telephone Association ceased to exist. Stehman, pp. 9-10

- [296]:

Garnet, p. 34

- [297]:

Brooks, p. 70

- [298]:

Ibid

- [299]:

Stehman, p. 18

- [300]:

Hubbard then became president of the Edison Speaking Phonograph Company. He later founded the National Geographic Society of America; Graham would one day also be associated with the Society and is credited with giving it the graphic appearance that survives to this day.

- [301]:

Forbes was a Bostonian as well and the son-in-law of Ralph Waldo Emerson. Paine, p. 139

- [302]:

Oslin, p. 191 When Gould succeeded in gaining control of the Union Pacific railroad, he canceled their contracts with WU under which WU managed the telegraphs constructed on Union Pacific’s right-of-ways. His basis to compete was the authority granted in a rider to the Army appropriations bill in 1879, which authorized railroads to perform commercial telegraph business, and the Sherman Bill of 1866, which would be interpreted to give telegraph rights to competitive telegraph companies on railroad property even though the railroad had signed an exclusive contract with WU. APT then signed telegraph contracts similar to WU with other railroads. By 1877, WU felt sufficiently threatened to succumb to back room intrigue and purchased APT from Gould, including a generous profit, and Gould became a large shareholder. ….”I found it uphill work….so we sold.” Asmann, p. 97

- [303]:

TBD Explain

- [304]:

Danielian, p. 42

- [305]:

Reich, p.134

- [306]:

Paine, p. 138

- [307]:

See Garnet Chapter 4 for an excellent review of this period.

- [308]:

Stehman, p. 16

- [309]:

Fagan, p. 31, and Coon, p. 59, and STONE, p. 36

- [310]:

REICH, p.134

- [311]:

VH 199

- [312]:

Brooks, p. 72

- [313]:

The New York Company was reorganized as the Metropolitan Telephone Company on March, 20, 1880 with a capitalization of $10 million. Oslin, p. 228

- [314]:

For an excellent review of these events see Garnet pp. 58-61

- [315]:

Stone, p. 41

- [316]:

All manner of injurious rumors were presently set afloat concerning the Bell patent. Other inventors – some of them honest men, and some shameless pretenders – were brought forward with concocted tales of prior invention. The Granger movement was at the time a strong political factor in the Middle West, and its blind fear of patents and monopolies was turned aggressively against the Bell Company. A few Senators and legitimate capitalists were lifted up as the figureheads of the crusade. And a loud hue-and-cry was raised in the newspapers against high rates and monopoly to distract the minds of the people from the real issue of legitimate business versus stock-company bubbles. Casson, pp. 89-90

- [317]:

This last language is directly from Rhodes, p. 72. This whole expisode makes for great reading. See Rhodes pp. 70-75

- [318]:

This first suit was in the Circuit Court of the United States for the Eastern District of Pennsylvania. When ABTC won on June 26, 1885, they then had to file against PETC in the Circuit court for the District of Maryland – filed July, 1885 and won in April 1888. In June 1886 ABTC filed in the circuit Court for the Northern District of Texas, and won in November 1886. The reason for the three different filings was because PETC had operations in Pennsylvania, Maryland, and Texas. See Rhodes pp. 217-218

- [319]:

Reich, p.137

- [320]:

ABTC formed Western Electric Co. which controlled its shares of Western Electric Manufacturing Co. These distinctions are ignored in this discussion. See:FCC p. 8

- [321]:

See FCC p.8 Most accounts have these facts wrong by stating that ABTC controlled 100% of WE after February.

- [322]:

Reich. p.135

- [323]:

Reich, P.137

- [324]:

Reich, p.177

- [325]:

One of America’s first science Ph.D.’s, William Jacques, came to work for Bell in 1880 and was assigned to the Electrical and Patent Department. Reich p.143

- [326]:

Reich, p. 136

- [327]:

In 1880, WE introduced their Standard switchboard. Rhodes, p. 157

- [328]:

Paine, p. 183

- [329]:

Rhodes, p. 118

- [330]:

Paine, p. 185

- [331]:

Garnet, p. 63

- [332]:

Reich, p. 143

- [333]:

RL138

- [334]:

Reich, p.177

- [335]:

Stehman, p. 33

- [336]:

Reich 135

- [337]:

Garnet, p. 70 and FCC p. 19

- [338]:

Leonard S. Reich, “The Making of American Industrial Research,” Cambridge University Press 1985, p. 137

- [339]:

Brooks, p. 82

- [340]:

Brooks, pp. 102-103

- [341]:

RL137

- [342]:

Paine, pp. 222-228

- [343]:

Rhodes, pp. 82-84, and Brooks pp. 102-103

- [344]:

RL, p. 138 This change in court attitude began with the Antitrust decisions handed down by the Supreme Court in 1897.

- [345]:

Coincident with the explosion in general economic activity after 1897.

- [346]:

See Gabel for an excellent study of competitive conditions.

- [347]:

FCC, p. 20

- [348]:

Stehman, pp. 25-29

- [349]:

The report of the 1880 meeting reads in part: The figures given by the various exchanges show that nearly all are groping in the dark for some system which shall make the compensation for the service given equitable, both for the public and our stockholders. Up to the present time, notwithstanding popular belief to the contrary, the public has had all of the profit and but little of the expense. Kingsbury p. 467

- [350]:

See Kingsbury, Chapter XXX for a more complete review. Author: Back to Hubbard’s shoe-making equipment.

- [351]:

FCC, pp. 9-10

- [352]:

TBD

- [353]:

David Gabel, Competition in a Network Industry: The Telephone Industry, 1894-1910, The Journal of Economic History, Vol. 54 No. 3 , pp. 544-545

- [354]:

Danielian, pp. 46-50 The back room intrigue of J. P. Morgan is inferred as no written record remains of the transactions.

- [355]:

George F. Baker and John I. Waterbury, were named to the Board of Directors.

- [356]:

Garnet, p. 125

- [357]:

FCC, pp. 149-177

- [358]:

The critical Supreme Court decision wasSmith v. Illinois Bell Telephone Company which ruled cost did matter and thus made the license contract a subject of regulatory review. Despite this clarifying decision, court battles would continue.

- [359]:

Ironically, once Bell converted to message unit pricing, many of the Independents offered an annual flat rate service, and were successful in doing so. See: Joan Nix and David Gabel, AT&T’s Strategic Response to Competition: Why Not Preempt Entry?, Journal of Economic History, Vol. 53, No. 2 A premise of this article is history matters, a theme to be more fully explore in this work later.

- [360]:

Fagan, Early Years. pp. 659-693

- [361]:

Kingsbury, p. 489 The development of private branch exchanges on the large scale now prevalent is an indirect result of the measured rate system.

- [362]:

Ibid., p. 666

- [363]:

Ibid., p. 693 Data on the unit growth of PBX’s before World War I are seemingly unavailable.

- [364]:

FCC, p. 129

- [365]:

FCC, p. 133

- [366]:

DB, p. 10 The FCC report of 1939 had the numbers as: Bell, 3,839,000, and independents, 2,280,000, with 755,00 independent telephones connected to the Bell system.

- [367]:

The intrigue behind this financing makes interesting reading. See FCC pp.87-93. It also marked the end of the Bostonians’ control of AT&T. Danielian has the face amount of the bonds to be $140 million and only $10 million were sold. See p. 71

- [368]:

TBD Asmann and others

- [369]:

Brooks, pp. 128-129

- [370]:

Coon, p. 106

- [371]:

Paine, pp. 231-232

- [372]:

Irwin, p. 21

- [373]:

Danielian, p. 102. Also Hoddeson, p. 529

- [374]:

Lillian Hoddeson, The Emergence of Basic Research in the Bell Telephone System, 1875-1915. Technology and Culture, Vol. 22, No. 3, , pp. 512-544. See especially pp. 528-530

- [375]:

Leonard A. Schlesinger, Davis Dyer, Thomas N. Clough, and Diane Landau, Chronicles of Corporate Change, Lexington Books, 1987, p. 8

- [376]:

Danielian, p. 102

- [377]:

Brooks, p. 130

- [378]:

The reader is referred to Louis Galambos, Theodore N. Vail and the Role of Innovation in the Modern Bell System, Business History Review 66 : 95-126 for an excellent discussion of the changes in the organization and goals of innovation within AT&T. Galambos labels what the author calls incremental innovation, adaptive, and radical, formative.

- [379]:

Hoddeson., pp. 530-531

- [380]:

The research budget in 1910 was $200,000. Manley Rutherford Irwin, p. 18

- [381]:

Galambos, p. 107. The reader is refereed to Galambos for an excellent discussion of the changes in AT&T’s research efforts.

- [382]:

Hoddeson, p. 536

- [383]:

The interested reader is referred to The Growth of the Regulatory State, 1900-1917, Edited by Robert F. Himmerlberg, Garland Publishing, 1994

- [384]:

Ibid., p. 46

- [385]:

Stehman, pp. 147-154

- [386]:

Danielian, p. 77 AT&T would later have to pay J. P. Morgan $2.5 million for their trouble when AT&T agrees as part of the Kingsbury Committment not to consumate the transaction.

- [387]:

The languageinPensacola Telegraph Co. v. Western Unionreads:”has changed the habits of business and become one of the necessities of commerce.”

- [388]:

Oslin, pp. 332-333

- [389]:

AT&T Annual Report 1910, Dordick, p. 230. Vail also wrote:”If there is to be State control and regulation, there should also be State protection – protection to a corporation striving to serve the whole community from aggressive competition which covers only that part which is profitable.”Oslin, p. 46

- [390]:

Gerald R. Faulhaber, Telecommunications in Turmoil: Technology and Public Policy, Ballinger Publishing Company, Cambridge, 1987, p. 6

- [391]:

Stehman, pp. 152-153. Also Garnett, pp. 152-153 In his letter, Charles A. Prouty argued that the value of a telephone service depends largely upon the facility of connecting every individual telephone user with any point upon any telephone line in the United States; but this should be attained under conditions which secure to the public the most reasonable terms consistent with a fair return upon the investment and under suitable supervision and control by your honorable body. *George Wickersham to Charles A. Prouty, 7 January 1913, 6, Section 4, Box 36, Record Group 60, National Archives, Washington D. C.

- [392]:

Kenneth Lipartito, System Building at the Margin: The Problem of Public Choice in the Telephone Industry, Journal of Economic History, Vol. XLIX, No. 2 (June 1989), p. 331

- [393]:

Jeffrey E. Cohen, The Telephone Problem and the Road to Telephone Regulation in the United States, 1876-1917, Journal of Policy History, Vol. 3, No. 1, 1991, p. 55

- [394]:

AT&T’s continuing involvement in telegraphy technology makes for interesting reading: FCC, pp. 232-234. Also it is clearly not obvious that spliting the telephone and the telegraph was in the public’s best interest. See Asmann pp. 150-160 Forcing AT&T’s system to handle only voice, not voice and telegraphy, presaged AT&T’s future resistance to handling both voice and data.

- [395]:

Oslin, p. 265